In April, Meta issued better-than-expected first-quarter results, but the stock plunged lower on a disappointing revenue forecast: Revenue increased 27% from $28.65 billion, the fastest rate of expansion for any quarter since 2021. Net income more than doubled to $12.37 billion, or $4.71 per share, from a year ago. The stocks recovered fairly well in a strong tech market, with AI getting a mention as is now de rigour; Mark Zuckerburg said, “On the upside, once our new AI services reach scale, we have a strong track record of monetising them effectively”.

To put some perspective on the spending across the tech goliaths – “Capital expenditures for 2024 are anticipated to be in the $35 billion to $40 billion range“ as we continue to accelerate our infrastructure investments to support our artificial intelligence (AI) roadmap,” Meta said.

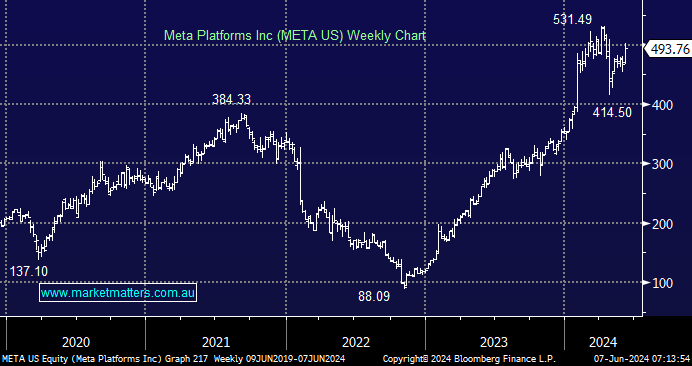

- We would be more inclined to be a seller of META above $US500 as opposed to a chaser of strength.