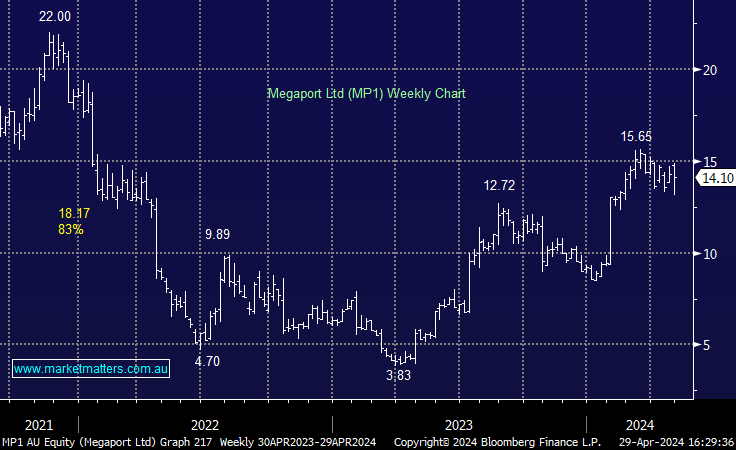

MP1 -1.33%: the network connectivity business struggled today despite upgrading FY24 expectations at their 3Q update. They now expect EBITDA of $56-58m for the year on the back of a $14m result int eh quarter. Free Cash Flow (FCF) came in ahead of expectations as well, up $1m on 2Q even after stripping out a $5.5m revenue share payment the company received in the period. The issue lies with softer than forecast Annualized Recurring Revenue (ARR) at just $199m, up ~4% in the quarter despite a strong currency tailwind. Customer growth was also slow, adding just 12 new names in the period, down from 39 in the 2Q. Additionally, while EBITDA was upgraded, consensus expectations were already towards the higher end of the previous $51-57m range.

- Interestingly, the guidance implies an AUD at 67USc which may mean these numbers are still conservative, though this was unable to offset the slight weakness in the underlying operational update.