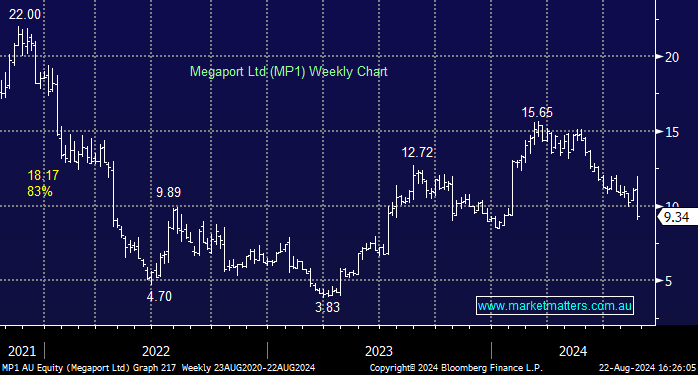

MP1 -20.95% plunged after guidance missed estimates, with the connectivity provider forecasting EBITDA for 2025 of $57-65mn, well below analyst expectations. The FY24 numbers were ok, but all eyes were on the guidance:

- Total revenue for FY24 was $195.3M, up $42.2M or 28% compared to FY23.

- Annual recurring revenue (ARR) up 14% to $203.9 million

- Gross profit in FY24 was $136.8M, up $32.9M or 32% on FY23.

- Megaport delivered a record EBITDA of $57.1M, in line with guidance, and up $36.9M from $20.2M in FY23.

- Positive cash flow was $28mnn.

MP1 achieved its first-ever net profit after tax for the year of $9.6M, up $19.4M on FY23’s net loss. The Net Cash Flow of $28.0M for the FY24 full year was a $62.5M improvement compared to FY23. However, the key takeaway was the missed forward guidance, which is not ideal for a stock priced for growth; we will likely remain on the sidelines into Christmas. A large $22.8mn block of shares traded early in the morning at $9.50, a 19% discount to Wednesday’s close, with one investor appearing to “abandon ship”.