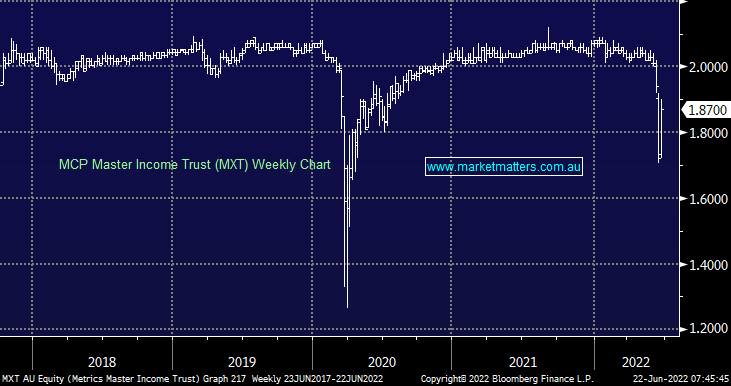

We hold this security in the Income Portfolio as a high yielding, defensive fixed-income position that has provided consistent returns since we invested at $2 in the initial listing back in 2017. Recently, there has been some selling pressure pushing the price of the trust down to $1.70, which equates to a ~15% discount to its underlying net asset value of ~$2. Metrics collectively manages around ~$7bn, with around $1.8bn being in the listed MXT. We caught up with MD Andrew Lockart yesterday with a focus on their lending in property, which is clearly an area of concern for the market given the challenges facing some developers (who operator on thin margins of typically 1-5%).

Post the catch up, our key thoughts are:

- They lend to developers at different stages of the development process, different stages have different risks however, high levels of security is sort at every juncture.

- MXT are a top tier manager in this space and know how to manage risk, with 100+ personnel on the ground sourcing transactions and managing the risk dynamics across their book.

- Loans are staged, are well secured against real assets, and they are involved in the process all the way through i.e. it’s not a case of write the cheque and hope for the best.

- Loans are variable in nature so returns will increase as rates increase.

- Heavy contingencies are built into all contracts.

- They have no loans in default or close to default.

These guys have a great track record, are incredibly professional and diligent in their approach with a vast depth of experience, and this clearly shines through.