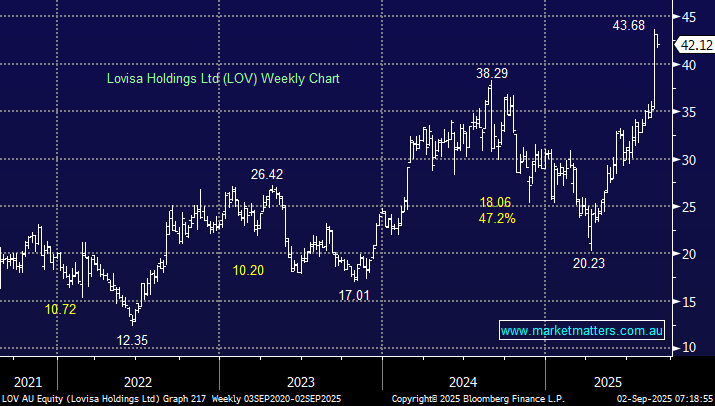

LOV was a popular stock in our 2024 Q&A, but it went quiet as the stock almost halved to its 2025 low. However, like much of the sector, it sprang back to life, punching to new all-time highs last week following its FY25 result and news that comparable store sales were up +5.6% in the first eight weeks of FY26. The stock received a mixture of upgrades and downgrades as it surged above $40 after the company increased its number of stores by 18.6% YoY. The retailer ramped up its global expansion to deliver a +14.2% lift in annual revenue to $798mn.

The $4.7bn fashion jeweller is still priced as a growth stock, which was definitely justified last year, with Europe the key growth driver. Their impressive margins didn’t slip last year, rising to 82% from 81% last FY, numbers to turn most companies green with envy. Earnings (EBIT) actually came in slightly below consensus for FY25, but the momentum moving into FY26 helped drive the stock higher. Similar to HVN and SUL, the stock is trading on a rich valuation, but operationally, it’s delivering.

- We like the risk/reward towards LOV on dips back towards $40.