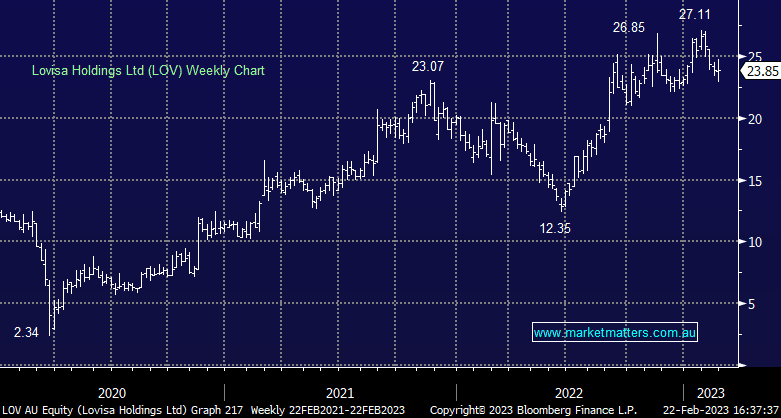

LOV -0.87%: jewellery retailer Lovisa finished lower today in a choppy session as the market digested their first-half result. Revenue was a 5% beat at $315m while EBIT was a slight miss at $70m vs $71m expected. Margin pressure coming through weighed on the numbers today and concerned the market, particularly given the stock is on over 30x PE on FY23 expectations. LFL sales growth for the first 7 weeks was in line with expectations, currently tracking +12.3% on last year while the new store rollout remains on track. Lovisa has done well in a tough market for retailers, it remains expensive but also an attractive stock if economic conditions improve.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

Monthly Update: Portfolio performance and positioning during October

Monthly Update: Portfolio performance and positioning during October

Close

Close

MM is neutral LOV

Add To Hit List

Related Q&A

Is Lovisa (LOV) a buy?

Lovisa (LOV)

Thoughts on IEL, LOV, FDV and TYR please

Does MM like currently PMV, LOV &/or SUL?

MM’s thoughts on LOV, PMV and SUL please

Would MM buy Lovisa (LOV) at current levels?

How does ASX200 Quarterly rebalance impact stocks?

Relevant suggested news and content from the site

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Recorded Thursday 20th November

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Video

WATCH

Monthly Update: Portfolio performance and positioning during October

Recorded Thursday 6th November

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.