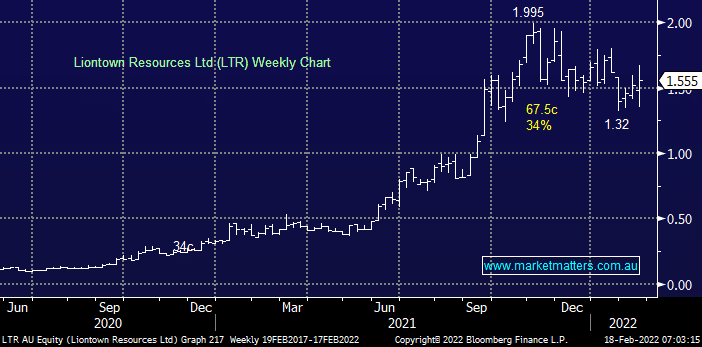

LTR is a relative minnow on the ASX with a market cap of $3.4bn, this is a name we haven’t really discussed previously but we like it around $1.50 from a risk / reward perspective. The company recently entered a lithium supply agreement with US EV car maker Tesla (TSLA US) which is a definite tick for the business moving forward – the initial 5-year agreement which was described as ‘binding’, although reading the detail suggests otherwise, kicks off in 2024 and we believe it should put a floor under the share price.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Gerrish: The correction is done, we’re positioning for what comes next

Gerrish: The correction is done, we’re positioning for what comes next

Close

Close

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Close

Close

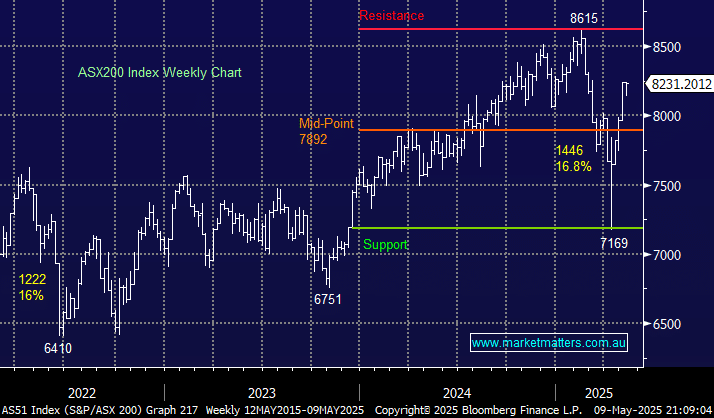

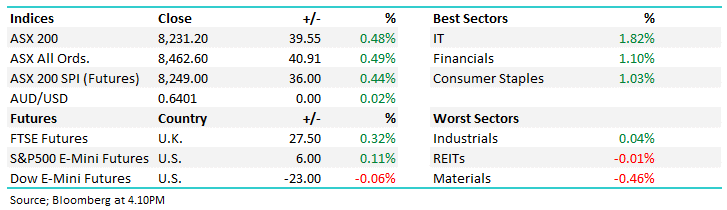

Friday 9th May – Dow up +254pts, SPI up +3pts

Friday 9th May – Dow up +254pts, SPI up +3pts

Close

Close

MM likes LTR around $1.50

Add To Hit List

Related Q&A

Lithium Stocks

Resource stocks are a hard call at times!!

Two Emerging Companies OR maybe not anymore!!!

Views on Leo Lithium (LLL) following their project sale

Views on LTR vs PLS/IGO

What are MM’s thoughts to buy PLS / IGO / LTM?

Thoughts on IPD Group (IPG)

Your updated thoughts on Liontown Resources (LTR) please

Thoughts on Liontown Resources (LTR)

Will LTR pop up on your Hitlist?

Thoughts on Liontown Resources (LTR) please

Liontown

Relevant suggested news and content from the site

Video

WATCH

Gerrish: The correction is done, we’re positioning for what comes next

The Market Matters lead portfolio manager talks the recent recovery, Trump, gold, and why he thinks there's plenty of opportunities.

Video

WATCH

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Recorded Monday 31st March

Podcast

LISTEN

Friday 9th May – Dow up +254pts, SPI up +3pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.