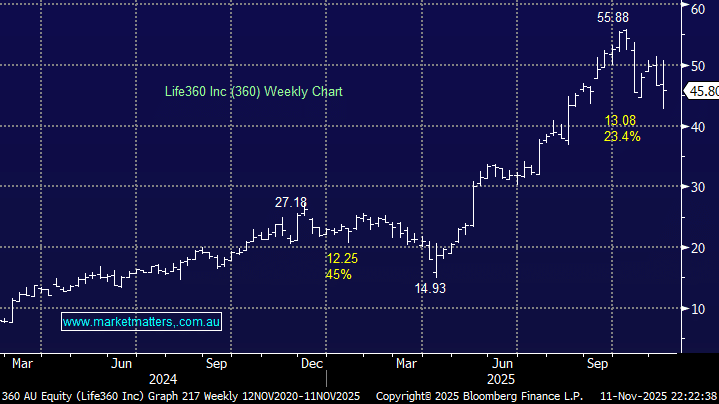

Life360 is an ASX-listed San Francisco–based, family connection and safety company that serves users across 180 countries through its app, Tile devices, and Pet Tracker, offering location sharing, driver reports, and crash detection to help families stay connected. 360 shares fell as much as 11% on Tuesday amid concerns over weaker-than-expected active user growth and, to a lesser extent, the acquisition of ad platform Nativo. At the same time, they also announced 3Q25 earnings that came in above consensus, and ugraded FY25 guidance for revenue and earnings (Ebitda) – a few moving parts to digest!

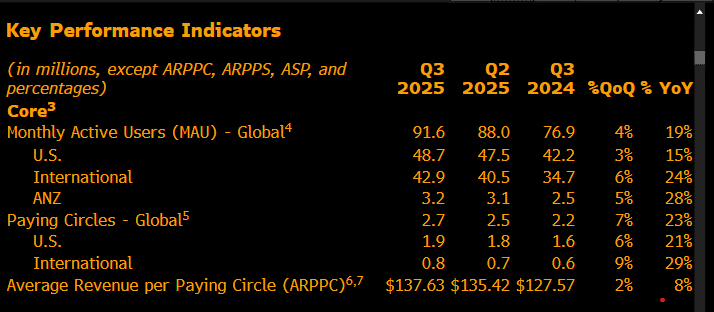

What really matters for 360 at the moment remains user growth, and on this metric, they missed – monetisation can come later. The third quarter results looked good at a glance, beating analysts’ expectations:

- Revenue $124.5 million, +34% YoY

- Adjusted Ebitda $24.5 million vs. $8.95 million YoY

- NPAT of $9.79 million, +27% YoY

- Monthly Active users 91.6mn, +19% YoY, a 2.5% miss to consensus.

The company raised its full-year revenue target to $474-$485mn, topping the consensus estimate by ~1% but all eyes were on the 2.5% miss in the number of active users. It’s clearly a concern when a $10.8bn company, which is priced for growth on 164x, falls short on this very metric. Revenue is still forecast to increase by 29% in FY26, but the stock is priced for the future, and that relies on continued an aggressive growth in platform participation.

- The big question is whether the slowing of user growth was a one-off or if the growth runway ahead is going to become harder and more expensive.

360 also announced on Tuesday that it had entered into a definitive agreement to acquire Nativo in a deal valued at approximately $120 million in a combination of cash and stock. Nativo’s comprehensive ad-tech stack, established sales team, and direct integrations with hundreds of publishers will extend Life360’s reach beyond its own app, allowing advertisers to engage across CTV, mobile, and web environments. We think this is an interesting deal, as it combines Life360’s intel on you and I, with Nativo’s creative and programmatic expertise.

- The acquisition adds the capabilities that typically take platforms years to develop. It will allow 360 to scale faster and bring high-quality, contextual advertising to market sooner.

The stock finished down 5.2%, recovering over half of its initial fall, as dip buyers entered, adopting the attitude that “Two Out of Three Ain’t Bad” – an old Meatloaf song in the 70s. At the current rate, we can see 360 achieving ~200mn users by 2030, but it doesn’t come without risk, as growth could slow faster (especially as penetration increases, competition from free alternatives intensifies, or regulatory/privacy headwinds rise).

- The user figures clearly show a reduction in the rate of growth across the board, but especially in the US.

When we weigh up the companies $10.8bn market cap and current valuation (PE of 164x – though we highlight this is not a good metric to use) against slowing user growth its hard to get too excited towards 360, even after the 23% pullback. We like their recent acquisition of Nativo and new product lines (e.g., pet/elder services), but would simply rather buy the stock at a higher price after seeing the user growth get back on track. Plus, there remains the very real platform risk (e.g., from Apple or Google built-in services): For example, Apple’s Find My Phone has the advantage of being embedded in its ecosystem (no extra app download required, broad device coverage), which suggests its reach could be far greater if it gets aggressive in this direction. 360 has pulled back into the area where we envisaged adding it to our Hitlist, but we don’t like the reason why.

- We like 360 as a business, its new product lines and Nativo deal, but find the risk/reward unattractive until we see a pick-up in user growth.