360 +27.37%: The family and pet tracking technology stock surged higher today after the company delivered an impressive preliminary 4Q update, jumping in US after-hours trade and following strongly on the ASX. The catalyst was a sharp re-acceleration in user and subscriber growth, directly addressing the market’s biggest concern from the September quarter.

- Revenue guidance upgraded to $486-$489mn from $474-$485mn

- Adjusted EBITDA guidance upgraded to US$87–92mn vs US$86.3mn consensus

- Monthly Active Users (MAU): 95.8mn and sees FY26 MAU growth at 20%

- Paid Subscribers: 2.8mn in 4Q

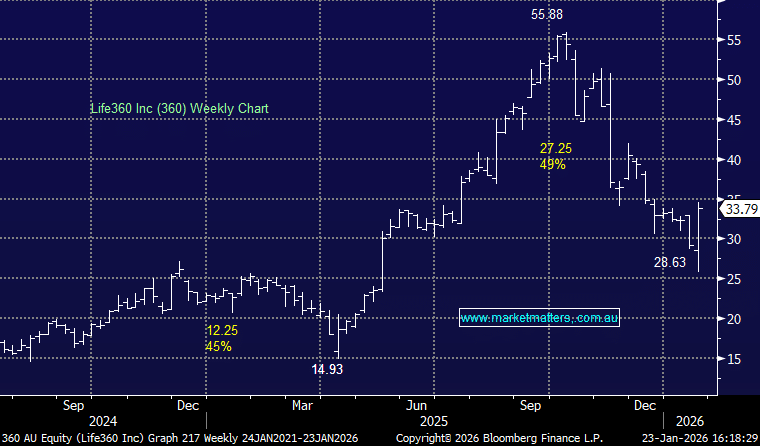

Back in November, we flagged that the market was almost entirely focused on user growth, not earnings. That uncertainty was a big reason the stock de-rated and why we were able to accumulate the name in the Emerging Companies Portfolio at more attractive levels a few weeks later.

This update flips that narrative. Not only have MAUs re-accelerated, but subscriber growth has hit record levels, reinforcing the platform’s monetisation flywheel. The business is demonstrating it can scale all sides of the model simultaneously – reach first, revenue second and earnings third.