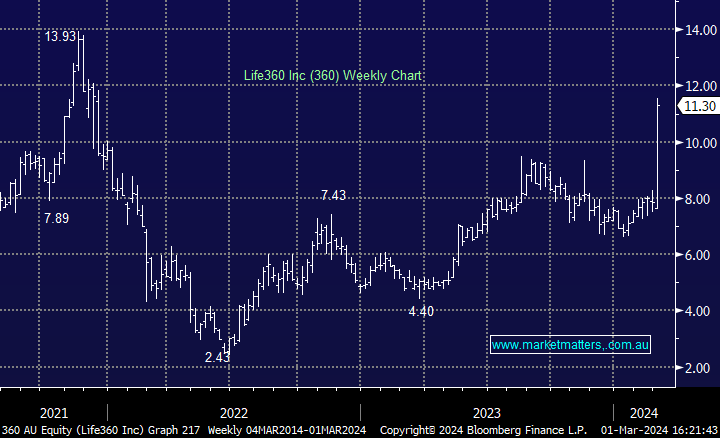

360 +38.48%: the share price of tracking and digital safety business Life360 surged into double digits for the first time since 2021 on a strong FY24 report out this morning. Earnings came home with a wet sail, EBITDA of $US20.8m was ~45% ahead of consensus and smashed the $US12-16m guidance out of the park. Hardware was the main driver, the company getting a sugar hit from better penetration in Australia, UK & Canada while revenue growth in the more mature US market was still 14%. Operating costs fell from 88% of revenue to 68% from CY22 to CY23, driving better margins. Guidance was also a ~10% beat to consensus, driven by further subscription growth and price increases.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

Monthly Update: Portfolio performance and positioning during October

Monthly Update: Portfolio performance and positioning during October

Close

Close

MM remains bullish 360, looking for a pullback

Add To Hit List

In these Portfolios

Related Q&A

MM view on Life360 (360) and WiseTech Global (WTC)

EOS electro optic systems, and Life 360 inc

Life360 Inc (36) and DroneShield (DRO)

US stocks listed in the US

PMV and 360

Thoughts on Life360 (360) please

Hold, or cut Life 360?

Thoughts on Life360 (360) and ZIP Co Ltd (ZIP) please

Relevant suggested news and content from the site

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Recorded Thursday 20th November

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Video

WATCH

Monthly Update: Portfolio performance and positioning during October

Recorded Thursday 6th November

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.