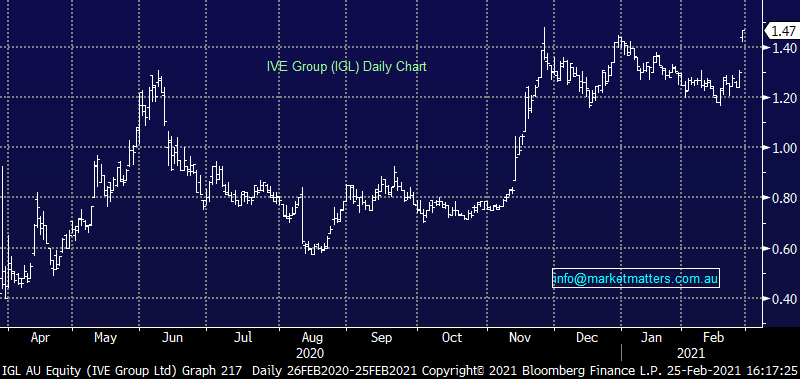

A very strong 1H21 result from the integrated marketing business and the stock should track higher from here. While top line revenue of $340.8m was pretty much inline, they’ve managed costs very well, margins have been improving and they’ve managed to pay down a lot of debt ($47m) during the half. While Job Keeper provided a decent benefit ($14.9m) operating EBITDA excluding Job Keeper was a strong beat. The half yearly net profit of $23m was just $2m below where the market was for the full year! Importantly, they also announced a 7cps dividend which annualised puts it on a yield of ~9%, which is actually more than it’s current P/E! They also reinterated FY21 EBITDA forecast of $100m post AASB changes. The stock ended 13.08% higher today.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Buy Hold Sell: The best and worst performers of FY25

Buy Hold Sell: The best and worst performers of FY25

Close

Close

Tuesday 15th July – Dow up +88pts, SPI up +51pts

Tuesday 15th July – Dow up +88pts, SPI up +51pts

Close

Close

MM remains bullish IGL

Add To Hit List

Related Q&A

Possible interesting moves in the IVE Group (IGL) share registry??

IVE Group Limited (IGL)

How much of a challenge is AI to IVE Group?

Two IGL directors selling large parcels of shares – any cause for concern?

Why is IVE Group (IGL) getting smashed?

Is the sell-off in IVE Group (IGL) overdone?

IVE Group (IGL) – is it time to sell?

What are MM’s thoughts on the surge in IGL’s share price?

What are thoughts on Calix, IGL, SIQ and SUL?

Thoughts on IGL Share Purchase Plan & the new norm for markets

IVE Group (IGL)

Relevant suggested news and content from the site

Video

WATCH

Buy Hold Sell: The best and worst performers of FY25

James Gerrish & Henry Jennings

Podcast

LISTEN

Tuesday 15th July – Dow up +88pts, SPI up +51pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.