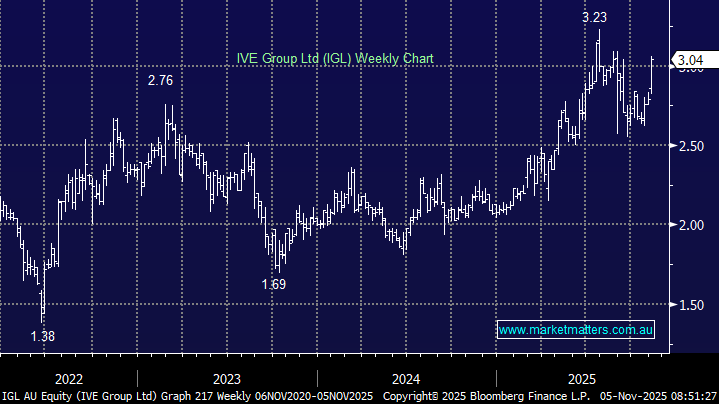

IGL is Australia’s leading integrated marketing business. From designing and executing marketing campaigns to printing, packaging, logistics and digital customer experiences, they are a true end-to-end services provider, servicing household names like Qantas, Reece, KIA, REA, Ladbrokes, and now Domino’s, following an interesting deal announced this week.

IGL has purchased Impressu, Domino’s’ own Brisbane-based print and logistics business, for $13.5m. As part of the transaction, Domino’s has signed a 6-year (+2 year option) marketing services agreement with Ive, initially expected to generate more than $80m in revenue during the tenure. The deal will initially bring another ~$30m revenue and ~$4.5m EBITDA (post-synergies) to IGL for an attractive price at sub-4× earnings (EBITDA) multiple. It also enhances IGL’s footprint in the fast-growing SE Queensland corridor.

This is the latest in a string of acquisitions, and they’ve demonstrated a good track record here, meeting or exceeding targets and generally integrating new operations well.

- While not a high-growth business by any stretch, IVE offers investors a rare combination in today’s market, trading on an Est PE of 9x while yielding close to 6% fully franked.

Important to note, there is a natural decline occurring in their traditional print business, however, packaging is an area of growth following their 2023 acquisition of JacPak, which does boxes for consumer products (e.g. healthcare, food, cosmetics), with new capacity coming online in 2025-27 with the group targeting ~$150m packaging revenue by FY29, which would add an estimated $20m-$25m to EBITDA.

- Given the undemanding valuation and structural evolution of the business, which continues to scale well, we think the stock remains underappreciated. A solid, long-term partner like Domino’s only adds to the investment case.