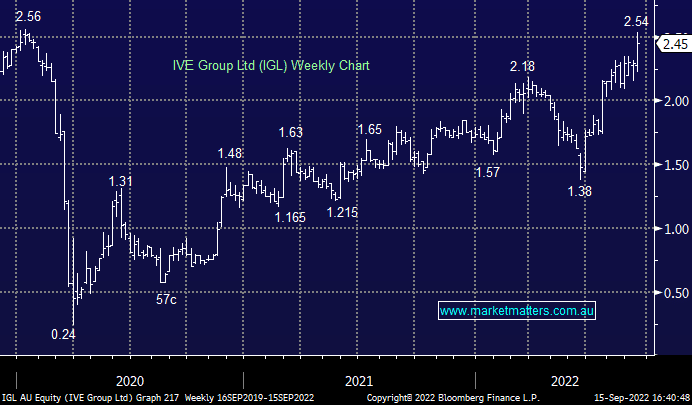

IGL -0.82%: Yesterday the company announced they had bought the majority of the printing and finishing assets of Ovato from the administrators. Ovato had previously been a major competitor and at one point they were doing $500m in revenues, however a bunch of factors sent them down the gurgler. Their demise cements IGL as the number 1 player in the printing space and gives the group pretty much every major retailing and bluechip customer in Australia. IGL has flagged that post integration OVT assets would be expected to generate ~$160m in revenue, $28m in EBITDA at a margin of 18% and $15m in underlying NPAT. It’s been a tough few years for the sector, and IGL could have easily followed OVT out the back door (probably saved to come degree by Govt support) but their management team have also done a great job.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM remains bullish IGL

Add To Hit List

Related Q&A

IVE Group Ltd (IGL)

How To Respond To IGL’s New Capital Management Policy?

Possible interesting moves in the IVE Group (IGL) share registry??

IVE Group Limited (IGL)

How much of a challenge is AI to IVE Group?

Two IGL directors selling large parcels of shares – any cause for concern?

Why is IVE Group (IGL) getting smashed?

Is the sell-off in IVE Group (IGL) overdone?

IVE Group (IGL) – is it time to sell?

What are MM’s thoughts on the surge in IGL’s share price?

What are thoughts on Calix, IGL, SIQ and SUL?

Thoughts on IGL Share Purchase Plan & the new norm for markets

IVE Group (IGL)

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.