IGL is Australia’s leading integrated marketing business, which we’ve owned in the past, that does everything from designing a marketing campaign, to print and communications, in-store merchandise & retail display to digital and customer experience. They work with some of the country’s best-known brands such as Qantas, Reece, KIA, Ladbrokes and REA, though they have a diverse customer base of nearly 3,000. They are an end-to-end service, and they’ve got scale. IVE has grown revenue from ~$400 million in FY2016 to ~$1 billion in FY2024, doubling earnings in that period ($53m exp in FY25) while paying out over $150 million in dividends to shareholders.

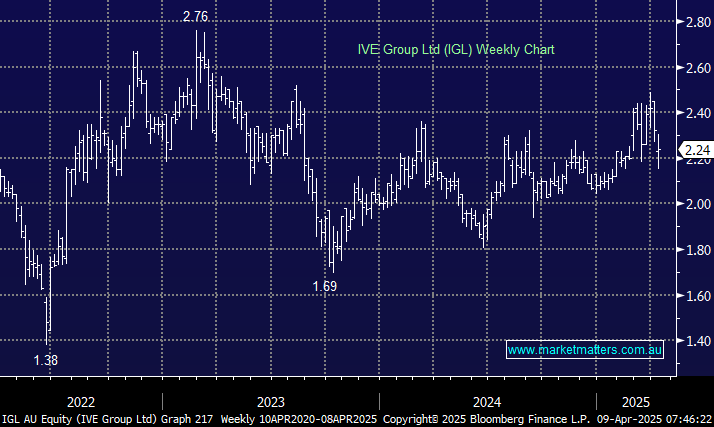

- This is not a growth business, with the top-line expected to grow less than ~2% per annum over the next few years, but with higher growth in earnings given scale benefits and margin improvement. Importantly, on an undemanding Est PE for 2025 of ~7× (~3.5× EV/EBITDA) plus an ~8% fully franked dividend yield, the stock seems more priced for a fall in earnings, not the reverse.

The economic backdrop does have an impact on IGL, who struggled under debt during Covid as marketing spend was reduced, however, they managed to navigate through that period without diluting shareholders via an equity raise and have come out the other side in better shape, with a manageable amount of long term debt (~$170m) and unlike many value stocks, they do have scope to grow organically, or via acquisition. While there is a natural decline occurring in their traditional print business, packaging is an area of growth following their 2023 acquisition of JacPak, which does boxes for consumer products (e.g. healthcare, food, cosmetics), with new capacity coming online in 2025-27 with the group targeting ~$150m packaging revenue by FY29, which would add an estimated $20m-$25m to EBITDA.

Acquisition has been a recent theme, and they’ve demonstrated a good track record here, meeting or exceeding targets and generally integrating new operations well. However, acquisitions do have risks, along with the potential for an accelerated decline in print or a more protracted economic downturn, these would be the major risks. Though the valuation and dividend, we suspect, will provide a reasonable offset.

- All in all, it is a value opportunity with some growth drivers, good management, trading on the cheap despite holding up well in the recent malaise and paying a very attractive dividend: IGL is on the Hitlist for the Emerging Companies Portfolio.