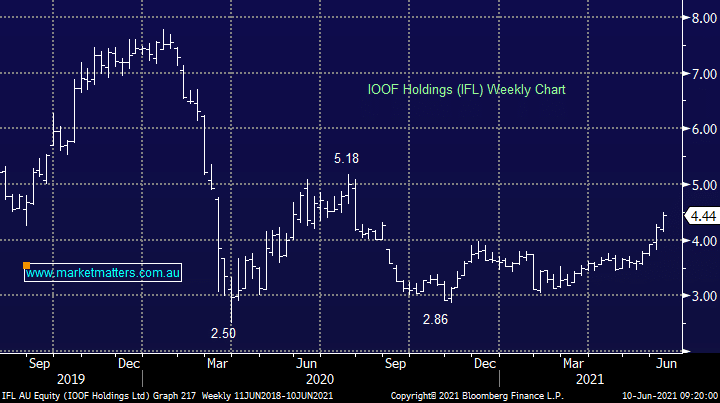

When we bought IFL in the Income Portfolio towards the end of 2020 the news flow was horrible, much like the backdrop was for the banks during their darker days, however as the negative rhetoric around financial planning has eased the stock has rallied. Despite the rally, it remains an inexpensive stock with better times ahead in MM’s view, and is paying a ~6% fully franked yield while we wait. We added to our existing position yesterday

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Buy Hold Sell: The best and worst performers of FY25

Buy Hold Sell: The best and worst performers of FY25

Close

Close

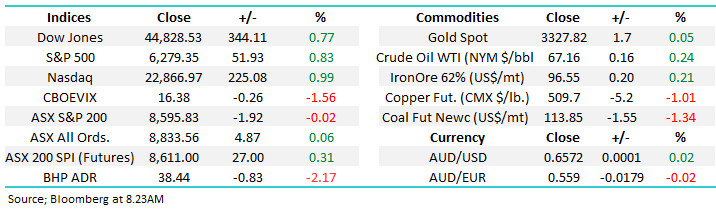

Friday 4th July – Dow up +344pts, SPI up +27pts

Friday 4th July – Dow up +344pts, SPI up +27pts

Close

Close

Thursday 3rd July – ASX -42pts, PME, NWH, GLF

Thursday 3rd July – ASX -42pts, PME, NWH, GLF

Close

Close

Global X Battery Tech and Lithium ETF (ACDC)

Global X Battery Tech and Lithium ETF (ACDC)

Close

Close

MM remains bullish IFL

Add To Hit List

Related Q&A

IFL – Buy, Hold or Sell

Fund Managers

Updated view on few battered up stocks?

Where’s IFL going?

Am I missing something on IOOF Holdings (IFL)?

MM thoughts on IFL & AMP

Why do you hold IOOF Holdings (IFL)?

Relevant suggested news and content from the site

Video

WATCH

Buy Hold Sell: The best and worst performers of FY25

James Gerrish & Henry Jennings

Podcast

LISTEN

Friday 4th July – Dow up +344pts, SPI up +27pts

Daily Podcast Direct from the Desk

Podcast

LISTEN

Thursday 3rd July – ASX -42pts, PME, NWH, GLF

Daily Podcast Direct from the Desk

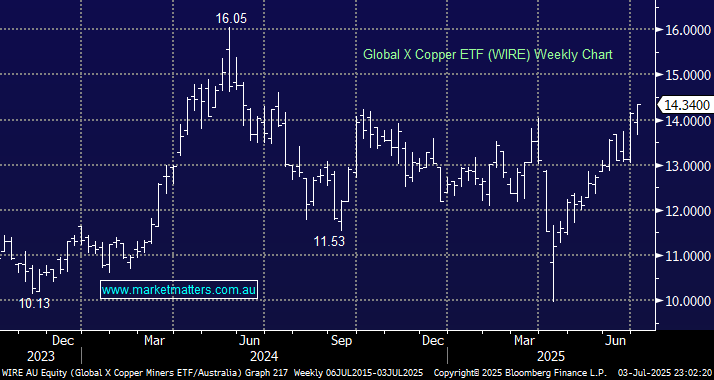

chart

Global X Battery Tech and Lithium ETF (ACDC)

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.