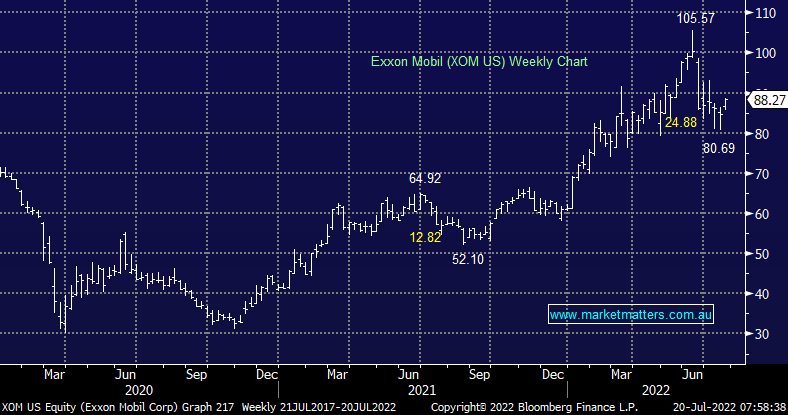

We are buying Exxon Mobil (XOM US) into recent weakness. We are bullish Oil from current levels and the worlds 2nd largest energy company should follow suit.

We believe commodities are oversold, specifically Copper with good risk/reward now obvious in Freeport MacMoRan (FCX US).

Given our overweight exposure in Asian facing technology and requirement for cash, we are taking a loss (~12%) on Tencent (700:HK), using proceeds to fund other purchases.