The Market Matters International Portfolio is a high conviction direct international equities portfolio that targets well known global brands – Click here to view

The portfolio had a solid week up +2.72% while cash remains at 15% affording us some flexibility to accumulate stocks into any weakness. We enjoyed standout performances by China facing Tencent (700 HK) +8.6% and JD.Com (JD US) +16.1% while our BHP position in London was not surprisingly the main casualty over the week.

At this stage we are considering one switch and one purchase in line with yesterday’s Energy note:

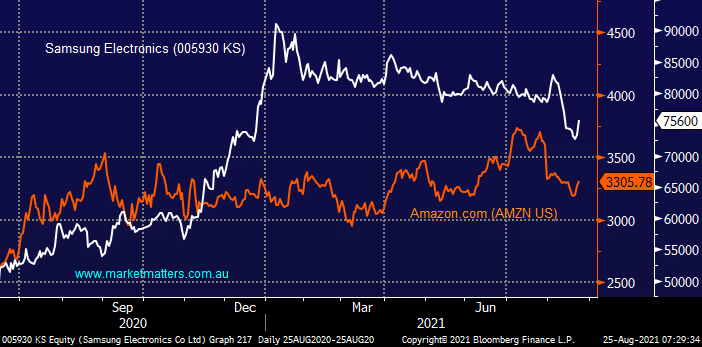

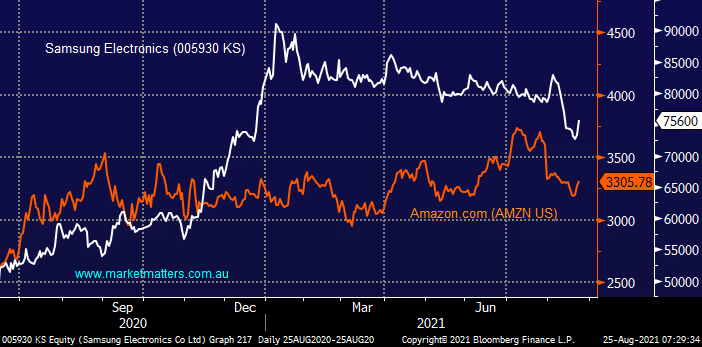

- Taking profit on our Samsung (005930 KS) position to establish exposure to on-line retail via goliath Amazon (AMZN US) – we flagged this last week

- Buy Exxon (XOM US) around $US55.

Our logic for the switch is unchanged – Samsung (005930 KS) has delivered for MM with some excellent gains over the last 2-years but we now feel the stocks simply tired and there are better places for these funds. Also we believe COVID has permanently changed peoples mindset towards on-line shopping / e-retail, we believe scale is the key here with Amazon perfectly positioned to extend its market dominance.