Australian 3-year bond yields remain above 4% after Friday’s strong US Jobs Report, but it’s tough to describe the price action as anything more than a holding pattern as investors and traders alike second-guess when the RBA will cut interest rates, rather than if they will cut. It’s been a year of speculation around when the RBA will move; it could be another 6-12 months before we get a definitive answer.

- We are targeting an eventual move by the local 3s down towards 3% in 2024/5, but softer news on inflation is required to turn the dial on local bonds.

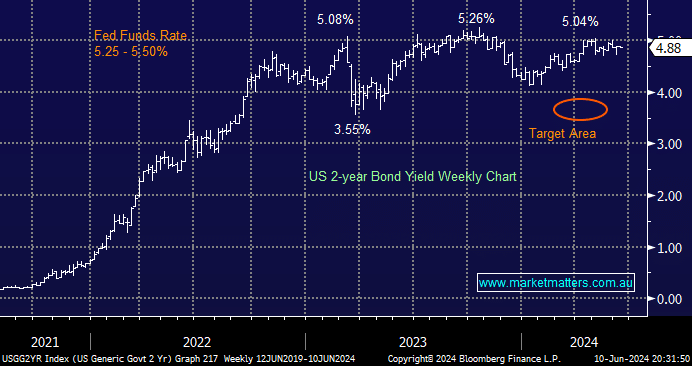

US bond yields remained firm after last week’s strong Jobs Report, but there was no explosion on the upside, as the 2s remain well below the psychological 5% level. At the start of 2024, the 2s were closer to 4% as markets priced in 3-4 cuts; now, after Friday, It looks like one cut at most this year by the Fed. We believe the market has gone from being overly optimistic towards cuts to now slowly venturing into the pessimistic corner.

- We’re ultimately targeting a move below 4% for the US 2s, but they’ve been around 5% for 12 months; they’re in no hurry to find a new level of equilibrium.