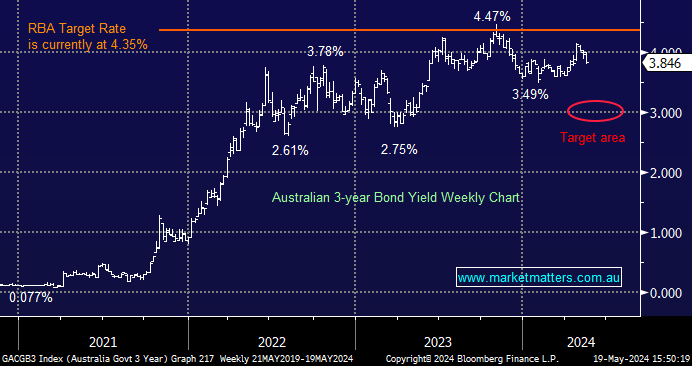

Australian 3-year bond yields again fell last week as the ducks aligned for the Doves. The US CPI came in lower than expected, following on from signs that the Australian jobs market was softening. The local futures market is now looking for a rate cut by February with hikes back off the table, a welcome relief for mortgage holders.

- We are targeting a move by the local 3s down towards 3% in 2024/5, a move which should provide a bullish backdrop for the market and especially rate-sensitive stocks/sectors.

When it comes to bonds, the local and US 10s have been dancing to the same music since COVID-19, and at this stage, we see no reason for the strong correlation to end. Conversely, the respective equity markets have been running their own race courtesy of sector weightings: the ASX is dominated by banks and resources, while the US is tech-dominated, with the latter having enjoyed the best relative performance since COVID-19.

- We’re targeting a retest below 3.5% for the Australian and US 10s through 2024/5 – both setting a positive backdrop for stocks.