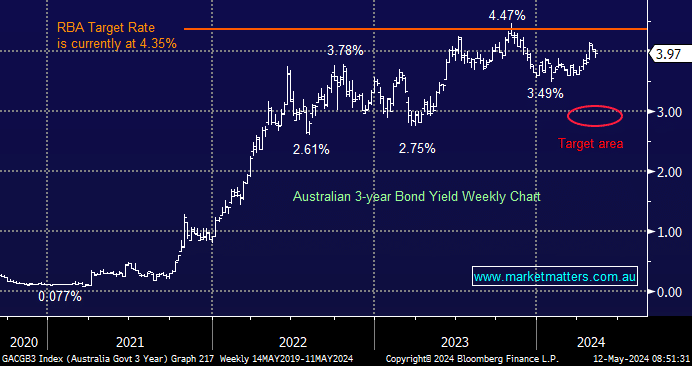

Australian 3-year bond yields again slipped lower last week after the recent “less hawkish” news from the RBA and Fed, but they will need some concrete signs that inflation is again turning lower before a decline back towards their 2024 3.5% low can unfold. The US CPI on Wednesday is likely to dictate terms for most bond markets this week, but we felt there were some signs last week that a degree of weakness is entering the Australian economy.

- Last week, retail sales dropped in the March quarter, the fifth decline in six quarters, while CBA reported in its trading update that loans in arrears are gradually rising across the consumer sector.

- We are targeting a move by the local 3s down towards 3% in 2024/5, a move which, as discussed, will provide a bullish backdrop for the market and especially rate-sensitive stocks/sectors.

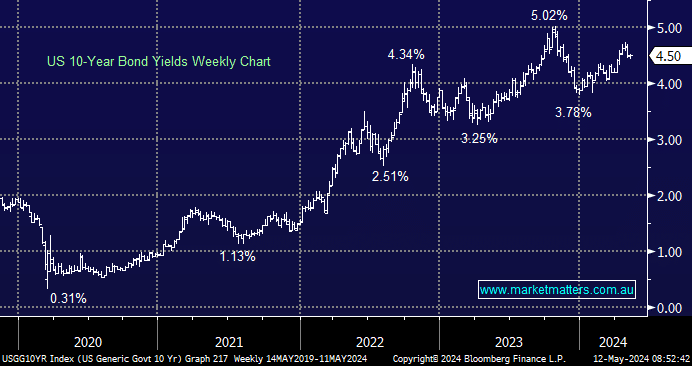

This month saw US policymakers leave rates unchanged, although they did reiterate that inflation is not beaten, the Fed’s view is their next move is likely to be a cut. Similar to the RBA, the Fed remains data dependent, which makes sense after they let inflation take control after being too slow in hiking interest rates following the massive injection of stimulus into the economy through COVID, i.e. they won’t want to ease monetary policy if there’s a perceived risk that any cuts may need to be reversed.

- We’re targeting a retest below 3.5% for the US 10s through 2024/5. A beat by the CPI on Thursday could set them on this path.