Australian 3-year bond yields surged higher last week after the hotter-than-expected inflation print. We’ve been looking for yields to eventually roll over back towards 3%, a view that we haven’t abandoned, but the push above 4% last week has certainly put the call on ice for now – technically, we need the 3s to trade back below 3.8% before the move will look to be unfolding.

- No change; we still believe the local 3s can test 3% in 2024/5, although clear signs of inflation turning lower will be needed for the next downside leg to unfold.

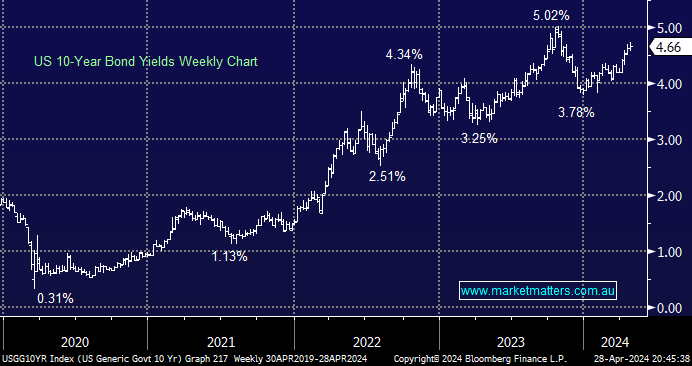

US policymakers are expected to leave rates unchanged this week; they sit at a restrictive two-decade high. As we said earlier, the focus will be on Jerome Powell’s press conference after the meeting. After previous worse-than-hoped inflation numbers, he’s said it would likely take “longer than expected,” and the Fed can keep rates high “as long as needed.” If inflation numbers don’t improve soon, it will start to look like rates won’t be cut at all in 2024, which is a scenario that equities aren’t currently positioned for, i.e. there’s plenty of room for disappointment.

- We’re still targeting a retest below 3.5% for the US 10s through 2024/5, but inflation will clearly need to fall to see this move unfold.