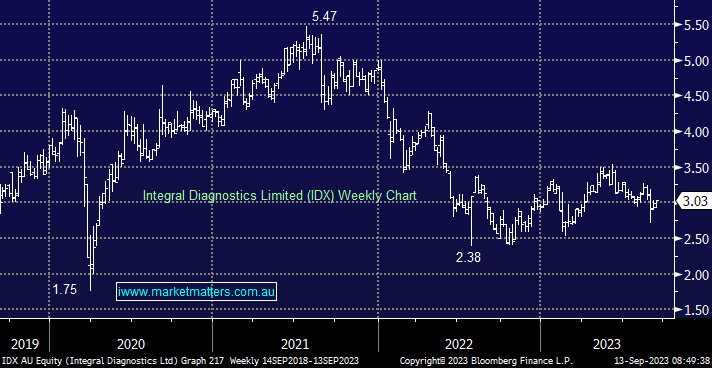

We have had no Healthcare exposure in the portfolio since cutting Capitol Health (CAJ) last month and while that call helped the portfolio outperform last month, the Healthcare sector is certainly a place we want to keep an eye on given the significant underperformance it has experienced this year.

Integral Diagnostics (IDX) operates 91 sites across Victoria, Queensland, WA and NZ, including 37 MRI machines. There are a number of similarities with Capitol Health (CAJ), but also some key differences given the geographical and services breakdown between the two. Integral has lower bulk billing exposure which provides better pricing capture and a lower reliance on GP referrals which has impacted CAJ. This was evident in a small beat by IDX at the FY23 result, driven by higher EBITDA margins supporting earnings.

Leverage is a little more of an issue for IDX with Net Debt to EBITDA of ~2.8x v CAJ at 1.4x, though this comes on the back of some significant acquisitions over the last 24 months. We expect both companies to continue to look at acquisitions at this stage in the cycle which will benefit earnings in future years but may weigh on shares near term with more debt or additional shares being issued. Both companies have seen earnings expectations revised lower post results, mostly on the back of higher interest costs.

- IDX trades on 24x PE vs CAJ on 19.5x, more expensive with higher debt, though a better business in our view