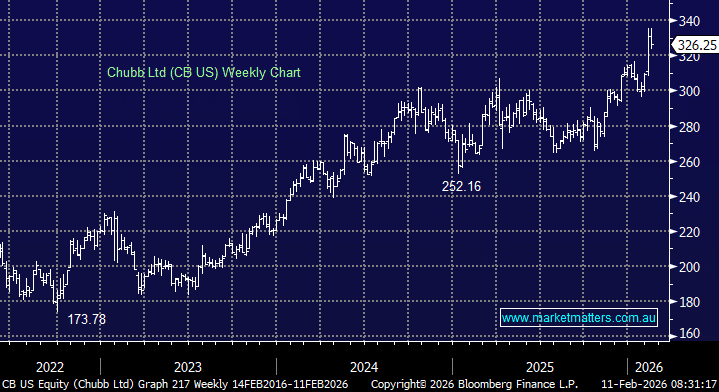

Insurers came under pressure on Tuesday, tracking sharp losses in US insurance broker stocks amid fresh concerns around AI-driven disruption in the sector. The brokers were hit hardest – Steadfast (SDF) -9.5%, AUB –6.1%, though the insurers themselves were also hit – Insurance Australia Group (IAG) -6.2%, Suncorp (SUN) -4.2%, while QBE slid 3.4%, as sentiment soured following news out of the US.

The weakness followed the launch of a new artificial intelligence tool by privately held online insurance platform Insurify, which sparked fears that AI could disrupt traditional insurance distribution models. Insurify said its app, launched on February 3, uses ChatGPT to compare auto insurance policies based on vehicle details, credit history, driving records and other customer data.

Nerves around AI disruption have intensified in recent weeks, spilling across multiple sectors after the release of new automation tools from Anthropic. Those tools are designed to automate tasks across industries ranging from legal and data services to financial research, amplifying concerns that AI could compress margins and disintermediate incumbents faster than previously expected.

While the sell-off looks sentiment-driven rather than fundamental, AI-led distribution and pricing tools remain a medium-term risk across many parts of the market – this sort of thing will continue to crop up we think.

- At this stage, there is no change to our positive view on the insurance sector