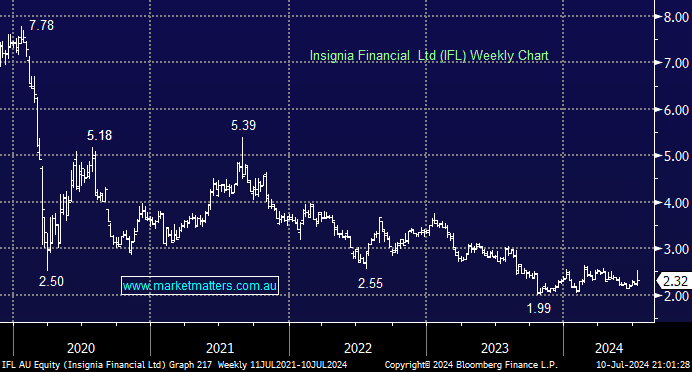

IFL dropped 7.2% on Wednesday, the most in eight months after the company stated that it was unaware of any offer and had not engaged Citi to field any such offers. The drop comes just one day after the stock surged to three-month highs following a story in the AFR that Private Equity giant Brookfield had the wealth manager under the microscope. We can see why they would be looking at IFL, but with so many deals falling over, we can’t imagine that the PE giant would have been very happy to read the story in the AFR if indeed it was true – “loose lips sink ships!”.

In May, IFL announced disappointing 3Q24 funds flows. Fortunately for the wealth manager, FUM was okay due to market gains, but with outflows accelerating, IFL hasn’t been on our radar through 2024. The MLC integration was completed over Easter, and we anticipate ongoing outflows towards Christmas. The adviser headcount and practice numbers fell across all disclosed categories during the quarter. Total adviser numbers fell by 8%, while practice numbers fell by 13%, which is now less than half the number of three years ago.

- The rise of Boutiques as technology levels the playing field is a structural headwind for the larger wealth management firms like IFL.