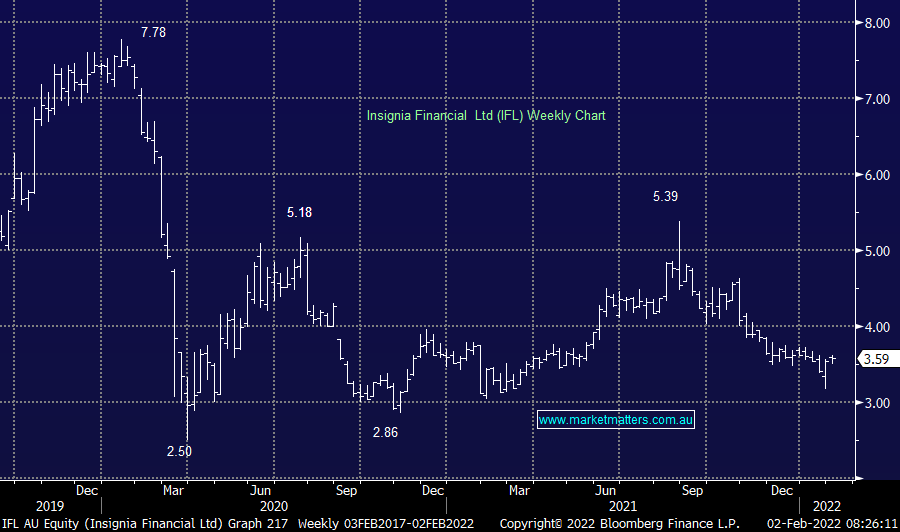

At the end of January, Insignia reported a better than feared quarterly trading update which showed early positive signs that their turnaround is working. While outflows continued and there are some swings and roundabouts in terms of adviser numbers declining again, the rate of outflows slowed markedly and there are positive signs emerging in the platforms and asset management side of the business. Based on consensus forecasts, IFL is trading on just ~9x FY23 earnings, with those earnings expected to be growing at mid to high single digits, with a dividend yield of 6.85% in FY22 jumping to 7.69% fully franked based on FY23 expectations. In short, our investment thesis has always been around a turnaround in the business that will improve earnings and when evidence of that emerges, the market will start to re-rate the multiple it is prepared to pay for those earnings. In the meantime, the dividend yield we believed was sustainable.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM has decided to hold IFL given a better quarterly update

Add To Hit List

Related Q&A

IFL – Buy, Hold or Sell

Fund Managers

Updated view on few battered up stocks?

Where’s IFL going?

Am I missing something on IOOF Holdings (IFL)?

MM thoughts on IFL & AMP

Why do you hold IOOF Holdings (IFL)?

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.