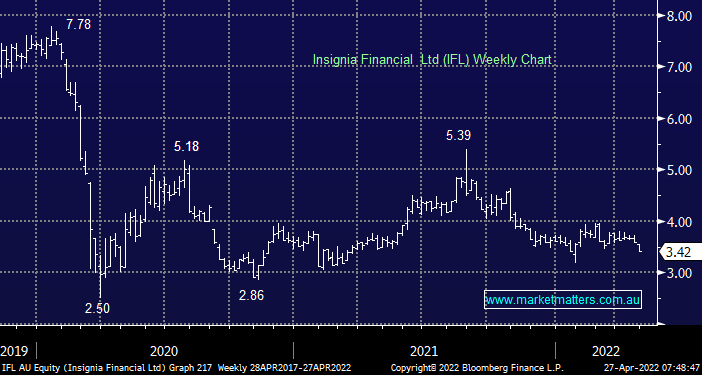

The financial advice and platform business was one of the weaker performers in the Income Portfolio during the week (-6.56%) having reported a 3Q22 trading update that was okay, but a lot of moving parts which we’ve come to expect from this value stock undergoing a turnaround. Fund Under Administration (FUA) fell $6.7b to $220.3bn, largely a result of market movements while Funds Under Management (FUM) actually saw net inflows of $332m, but that wasn’t enough to offset the impact of the market which detracted $2.3bn, leaving total FUM at the end of the quarter at $96.9bn. One of the main focal points was the loss of 83 advisers bringing the total number down to 1682. The CEO Renato Mota, who we rate highly, talked to the loss of smaller practices as the key contributor here, in other words, they seem content to focus more heavily on the larger practices. This is a trend we’re seeing across the board, even internally at Shaw where the focus is very much shifting to adviser quality rather than adviser numbers. As the cost of delivering services increases (due to higher regulation) & the cost of compliance staff, licensees need more focus when directing resources, and ‘dropping the tail’ has been the obvious strategy. IFL remains an inexpensive (Est P/E of 9.2x with a projected yield of ~9%) turnaround story, however patience is needed.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Buy Hold Sell: The best and worst performers of FY25

Buy Hold Sell: The best and worst performers of FY25

Close

Close

Friday 11th July – Dow up +192pts, SPI up +27pts

Friday 11th July – Dow up +192pts, SPI up +27pts

Close

Close

MM remains a patient holder of IFL in the Income Portfolio

Add To Hit List

Related Q&A

IFL – Buy, Hold or Sell

Fund Managers

Updated view on few battered up stocks?

Where’s IFL going?

Am I missing something on IOOF Holdings (IFL)?

MM thoughts on IFL & AMP

Why do you hold IOOF Holdings (IFL)?

Relevant suggested news and content from the site

Video

WATCH

Buy Hold Sell: The best and worst performers of FY25

James Gerrish & Henry Jennings

Podcast

LISTEN

Friday 11th July – Dow up +192pts, SPI up +27pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.