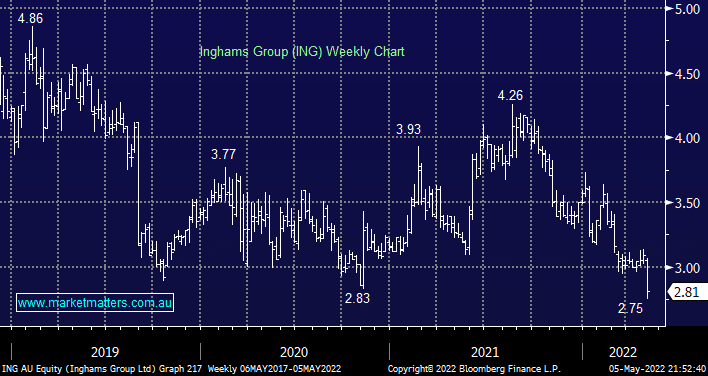

Poultry business Inghams has seen its shares plunge to all-time lows this week even after delivering profit for HY22 up 5.9% to $39.7mn, but signs are arising that Omicron has started to impact the business. The stock is forecast to yield in excess of 6% over the next 12-months but that’s irrelevant if the shares keep sliding lower. We do like the relative stability of this business but we would be considering an “accumulation into weakness” approach as opposed to an aggressive buy with Septembers dividend the 1st objective.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Gerrish: The correction is done, we’re positioning for what comes next

Gerrish: The correction is done, we’re positioning for what comes next

Close

Close

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Close

Close

Friday 9th May – Dow up +254pts, SPI up +3pts

Friday 9th May – Dow up +254pts, SPI up +3pts

Close

Close

MM is neutral ING

Add To Hit List

Related Q&A

Ingham Group Ltd (ING)

Following up on Inghams Group (ING)

Why is Inghams (ING) still going backwards?

Thoughts on – CAJ, HLS & ING please?

Inghams (ING) view

Paladin (PDN) – is it a buy?

Relevant suggested news and content from the site

Video

WATCH

Gerrish: The correction is done, we’re positioning for what comes next

The Market Matters lead portfolio manager talks the recent recovery, Trump, gold, and why he thinks there's plenty of opportunities.

Video

WATCH

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Recorded Monday 31st March

Podcast

LISTEN

Friday 9th May – Dow up +254pts, SPI up +3pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.