Diversified international chemicals manufacturer IPL received over 57% of its revenue from the US in 2022, its fairly cheap after struggling through 2023 with the stock now trading at a FY24 P/E of ~12x which is a 15% discount to the 10yr average. IPL disappointed investors in May when its 1H23 EBIT missed analyst expectations by ~19%, the stock still hasn’t fully recovered and we believe improved operational performance is required to recapture investors’ appetite.

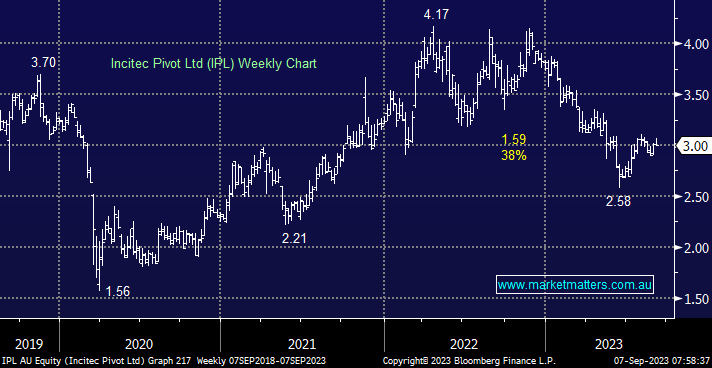

- We can see IPL testing $3.25 resistance but it’s not overly exciting ~$3.