Hi Nick,

IPL has announced the divestment of the 800kmtpa WALA ammonia plant to CF Industries for net cash proceeds of A$1.25bn (post tax and off-take), the strategic impact of the transaction means that IPL decreases its ammonia price exposure i.e. operational risk. The transaction moves IPL into a net cash position while supporting the demerger and capital management plans. We expect IPL to be in a position to start its A$400mn share buy-back after the 1H23 result (17 May).

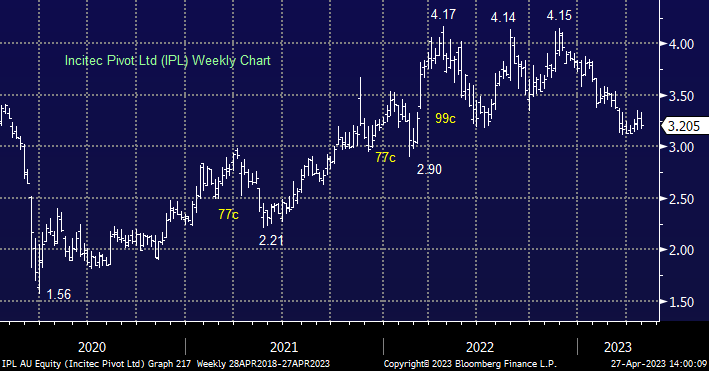

IPL had been the beneficiary of record high fertiliser prices over the last 12-18 months, however, both ammonia and DAP are now down c.65%/40% from April 2022 peaks – this speaks to lower earnings ahead, a similar trend as we have seen in other agriculturally exposed stocks in recent times, and would be the reason for the SP weakness.

We have IPL trading on an Est. 7.5x valuation for 2023 while its expected to yield 6.9% over the coming 12 months, like yourself we believe the stocks starting to show value in the $3-3.20 region but MM is unlikely to pull the trigger in the near future.