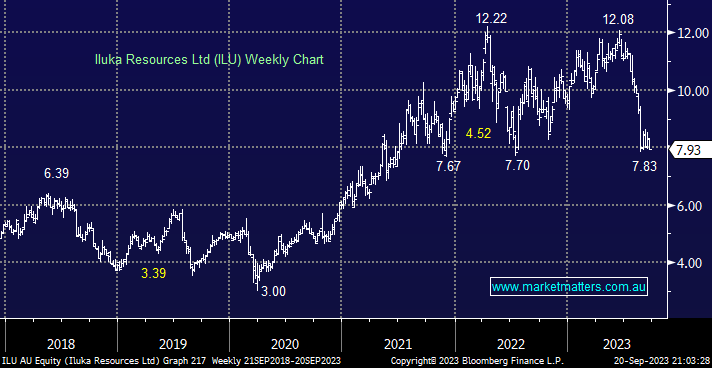

ILU slipped another -3.4% yesterday, taking it within a few ticks of its 2023 low. We sold ILU back in June at $11.66, a combination of strong outperformance vs. the broader resources sector and signs Chinese demand was easing saw us lock in a ~15% profit – since then, it has been all one way traffic.

A month ago, the selling intensified following weak production amid softer demand for mineral sands, and the company announced that they will pause some production of synthetic rutile, used in the likes of paints for four months as the uncertain global economic outlook weighs on demand. As we said at the time, it is “potentially a prudent move, but it is unlikely the stock will rally until the news flow improves”. However, the global economy is looking increasingly likely to avoid a recession, which should help resource stocks more generally into 2024, just the outlook for Mineral Sands has deteriorated further.

- ILU is on our radar, however further downside seems likely in the short term.