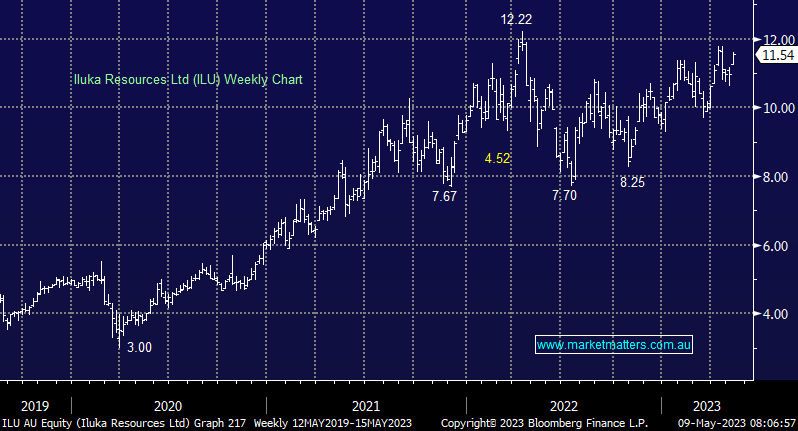

Iluka (ILU) rallied strongly yesterday with better rhetoric stemming from both their mineral sands operation along with their push into rare earths, which is the key swing factor for this interesting commodity stock. Rare earths are used in the magnets that form the main propulsion in electric motors, and this is the zing that should underpin Iluka’s future growth. Ultimately, they need stability in their traditional mineral sands operation, where their products are used in paints, ceramics and other building-related products, to finance the push into more ‘future facing’ commodities.

- In terms of mineral sands, at last week’s Macquarie conference, they provided a production outlook for the first time and highlighted steady output likely through CY23-CY25. This means their cash generator looks on-song to fund the exciting transformation projects ahead.

- In rare earths, they are advancing the Eneabba phase 3 project which consists of the construction of the first integrated rare earths facility in Australia, and this remains on track.

However, its share price performance continues to show a strong correlation to mineral sands prices given the rare earths projects are still under construction. Rare earth companies are trading on significantly higher valuations than ILU, however, the proportion of their earnings that will come from rare earths in the future will increase meaningfully, from ~3% today to around 15% in the next 5 years.