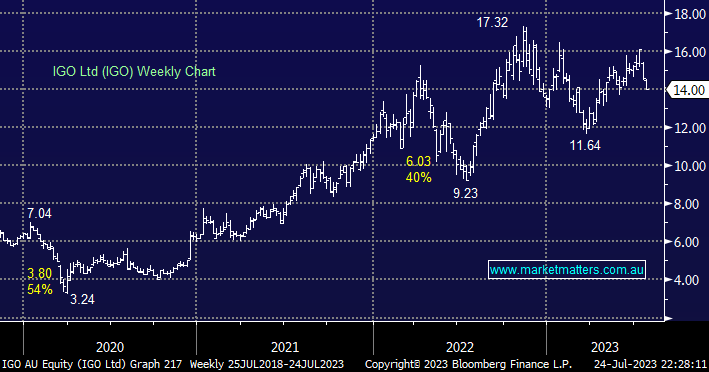

IGO has been under pressure for the last few weeks after they announced a non-cash and pre-tax impairment of $880-$980m for assets they bought from Western Areas just a year ago – integration as well as the development of ESG assets can be a tough gig reiterating our opinion that valuations are often too optimistic in this space.

- We see no short-term reason to buy IGO at current levels even if it is a popular ESG business i.e. ~75% lithium & 25% nickel.