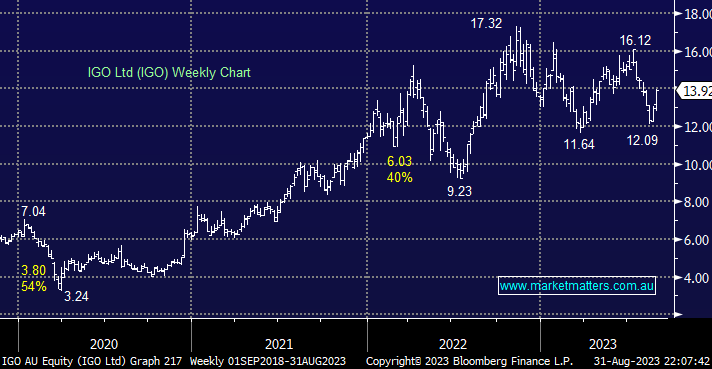

IGO closed up +5.45% on Thursday popping the most in 2 months after reporting a strong FY23 result plus they announced a 44c final dividend plus a 16c special dividend (60cps total). This lithium and nickel miner has successfully put the Western Areas (WSA) billion-dollar write-down behind it managing to deliver over $1bn revenue for FY23 even with depressed commodity prices, it could become an attractive “cash cow” if the lithium price were to advance further.

- We said earlier in the week that we liked IGO around $12, after yesterday’s solid result we think it still looks good sub $14.