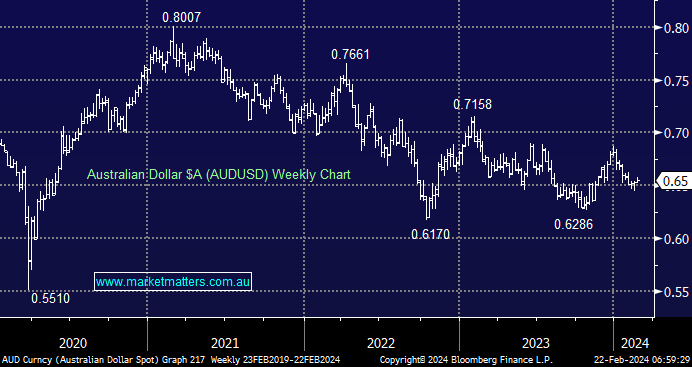

UBS called the $A back to 72c as one of its best trades of 2024, a meaningful ~10% gain from current levels – great news for overseas holidays if they’re on point. Their fundamental logic is simple and hard to fault, although translating it into a 10% gain for the little “Aussie Battler” feels like a big call this morning.

- They believe the Fed will cut four times this year, weighing on US bond yields and the Greenback alike – the futures market agrees, pricing in around four 0.25% cuts by Christmas.

- In contrast, UBS believes the RBA will be the last G10 central bank to cut rates – the futures market doesn’t agree, pricing almost two 0.25% cuts by Christmas.

Both central banks continue to talk down rate cuts, which MM believes is prudent, while the battle against inflation is heading in the right direction but is far from over. We do believe the Fed will cut faster and sooner than the RBA, which will exert upside pressure on the $A. However, there is a second important side to this equation, that of commodity prices, which historically are a tougher call – we are bullish on China and commodities through 2024/5, but this could derail UBS’s $A thesis based around interest rate differentials. However, UBS is also bullish towards the beaten-up Chinese stock market – a similar stance to ours.

- We believe interest rates have peaked, but the path of cuts may still be a more cautious than many investors are hoping.

Post-COVID and especially since late 2022, the main US indices have outperformed the ASX, with the now famous “Magnificent Seven” dragging the broader US market ever higher. The correlation between the $A and the relative performance between the respective indices is strong, and assuming the $A is poised to rally through 2024, it is fair to assume that the ASX will outperform US indices, just at a time when many local investors are experiencing “FOMO” (Fear of Missing Out) with regard to the impressive bullish advance by most US tech behemoths.

- We can see some performance reversion between the respective indices supported by a stronger $A.