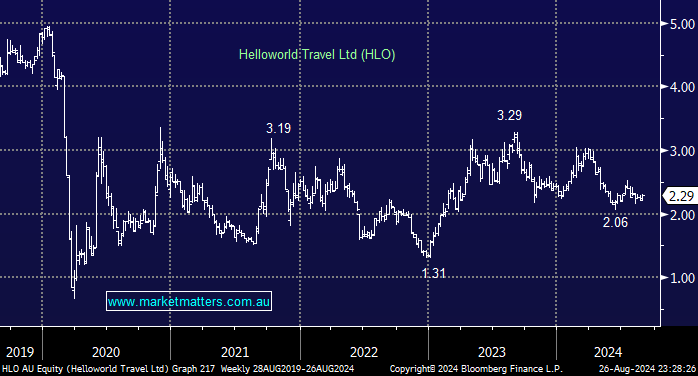

Last month, we added HLO to our Emerging Companies Portfolio around current prices, following plans laid out when we covered HLO over recent months. For subscribers unfamiliar with HLO, it’s a $370mn travel business born in 2017, comprising of legacy brands Harvey World Travel, Travelscene, Jetset, and Travelworld.

HLO have reported results this morning, with Total Transaction Value (TTV) of $4.17 billion, up from $2.57 billion in FY23 representing an 62.5% increase.

- Revenue grew strongly, up 37.5% year-on-year to $228.2m in FY24, slightly lower than $231.2m consensus

- Underlying EBITDA of $67.5 million compared to $44.1 million underlying EBITDA in the prior year, and was inline with consensus and the midpoint of guidance ($64m-$72m).

- Net profit after tax increased to $30.7 million, up 60.2% year-on-year, however, this looks light on, and we need to understand why.

Clearly good growth coming though, and we like the risk/reward towards HLO ~$2.30.