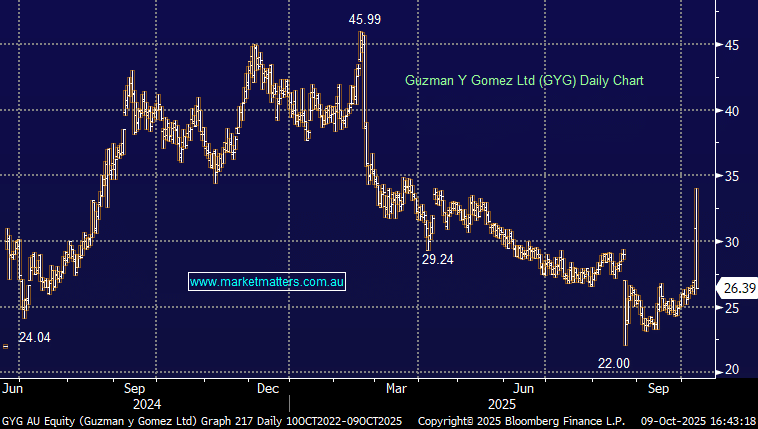

GYG -2.26%: Shares soared +26% in early trade after the AFR reported a $100bn buy-back before later clarifying it was $100m – bit of a difference, bringing shares back down to Earth before ending the day lower.

The quarterly update was underscored by healthy sales growth in Australia (+4%) and the US (+6.7%), with five new openings further expanding its global footprint and an additional 32 new restaurants in Australia this year.

- EBITDA margins are expected to lift to 5.9–6.3% in FY26 vs 5.7% in FY25

- A $100m on-market buyback earmarked for Q2 FY26

The forward blended P/E of ~120x remains lofty for the fast-food goliath, though it has halved from ~240x at listing, with investors now paying a little less for solid growth and momentum in store rollouts, though clearly the market isn’t convinced on the numbers just yet based on today’s price action.