GQG was the market’s best-performing stock on the main board yesterday, advancing by over +9% for a couple of reasons:

- The fund manager has underperformed since mid-2024 after adopting a conservative approach to their investments, too early in hindsight, which led to outflows, but recent performance has improved.

- Further, GQG announced it had increased its stakes in 5 Adani Group companies, including another 5.39 million shares in Adani Energy and 5.34 million shares in Adani Enterprises – the market embrace the news.

Ironically, Adani is the same group that led to a sharp decline in GQG shares in late November last year when Gautam Adani and several other senior Adani-group executives were indicted by U.S. authorities on charges of bribery, fraud and related allegations – due to their large position in the group, GQG’s shares plunged ~20% in one single day.

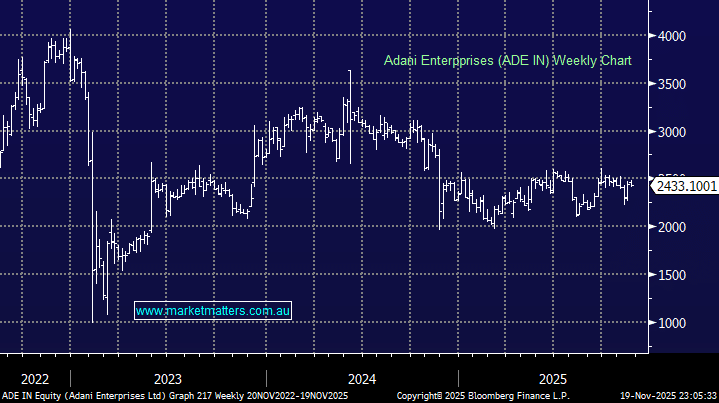

- Adani Enterprises looks to have found a base.

Even after rallying almost 15% from this week’s low GQG remains seriously cheap, trading on 6.8x, a steep 30% discount to the last 5-years average valuation, while the stock is forecast to yield well over 10% in the next 12-months. The earnings impact of recent outflows is minor at this stage, as we said last week, it’s more a pricing in of concerns about an escalation of redemptions in the future. While Nvidia’s result was positive, and the AI trade still has legs, the recent wash out we’ve seen will likely underpin investor appetite for greater diversification into stocks more aligned with GQG’s current positioning.

We also doubt investors will pull lots of money out of GQG funds chasing the AI trade after recent volatility. The market is pricing large and ongoing outflows, which may not materialise. If we price GQG on 10x earnings, it’s worth well over $2, leaving plenty of upside for a high-yielding stock.

- We like GQG around the $1.60 area, and hold it in both our income and growth portfolios.