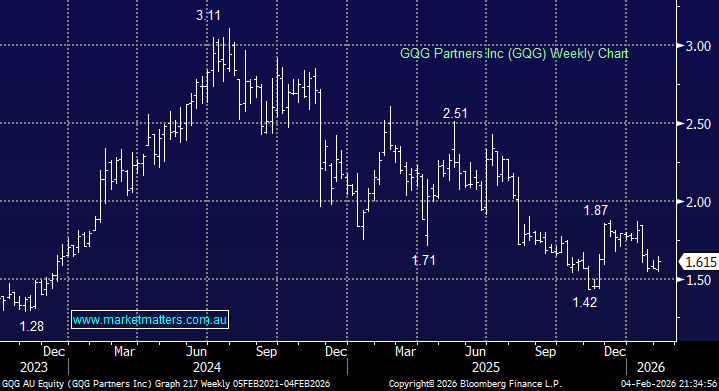

We hold GQG in our Active Growth and Active Income Portfolios because they’ve got a good long term track record, but have struggled recently, compressing its valuation. GQG has materially underperformed the market in recent times leading to fund outflows and a significant re-rate lower in their share price. Their underperformance was caused by their strong and well-publicised belief that we are in a tech bubble and the subsequent early exit from the space, but recent moves are starting to add some weight to their arguments, and a positive re-rating feels like a matter of time to MM.

Starting in September 2025, they published a series of papers on technology, valuations, and the impact on AI. Their ultimate conclusion was that tech is in a bubble, and the bubble is likely to burst. They sold all tech holdings, retreating to a more ‘old world’ portfolio. As time has evolved and further progress has been made on AI, importantly, we believe their warnings are valid, and as stewards of capital, we should take note and take action to mitigate the increasing risks in this space.

- GQG’s Dotcom on Steroids research series delivered a clear and increasingly forceful warning: while AI is undoubtedly transformative, the financial returns being capitalised by markets today may be overstated, and in some cases artificially inflated by the capital cycle itself.

At the heart of the thesis is the idea that many large technology companies now represent “backward-looking quality”. They are exceptional franchises, but face slower growth, intensifying competition and rising capital intensity. Despite this, valuations embed assumptions of sustained high returns and near-frictionless scalability. AI has amplified this disconnect. Hyperscalers are spending at unprecedented levels, but free cash flow volatility is rising, margins are under pressure, and incremental returns on capital appear to be declining.

What began as a valuation and quality concern has evolved into a much broader risk for equity markets, as AI-driven earnings growth, particularly in the S&P 500, is far less durable than it appears. Despite extraordinary user growth, much of today’s AI demand is still subsidised, highly price-sensitive, and skewed toward free-tier usage.

AI will change the world; that much is not in doubt. But history shows that transformational technologies do not guarantee transformational investor returns, particularly when capital floods in faster than sustainable demand can absorb it. The risk today is not just elevated valuations. It is that earnings themselves are overstated, flattered by a late-stage capital cycle that may already be peaking. When the CapEx merry-go-round slows, the market may discover that the boom was real, but the profits were not.

- We believe GQG is poised for a bullish re-rating and are looking to increase our weighting