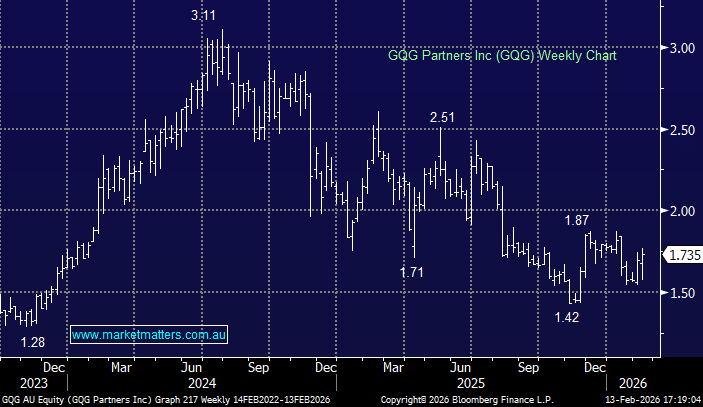

GQG +7.76%: Delivered solid FY25 earnings growth that came inline with consensus expectations. Portfolio underperformance has characterised the year, however CIO Rajiv Jain believes their bearish stance toward technology and AI remains the right call.

FY25 results

- Net income: US$463.3m, +7.3% y/y – inline

- Net revenue: US$808.3m, +6.3% y/y – inline

- 4Q dividend: US$0.0365/share – inline

Operationally they were solid despite net outflows, highlighting the scalability of the model and cost discipline. Flows remained volatile, with December redemptions totalling US$2.1bn, followed by US$4.2bn redeemed in January. Funds under management finished December at US$163.9bn (up 7% y/y) and have since rebounded to US$172.4bn – which is at record levels.

Jain argues GQG was “early, not wrong” in cutting technology exposure last year, claiming the underpinnings of the AI theme have deteriorated. That stance has been painful in the short term: GQG’s US equities strategy fell ~5% last year, versus a ~18% rise in the S&P 500. GQG are now meaningfully overweight consumer staples, utilities and healthcare, and has no intention of buying the dip in software.

Overall, GQG’s earnings are holding up, but flows and near-term performance dominate the narrative. The stock is effectively a high-conviction macro bet on a rotation away from technology, or, a way to hedge some bets on technology, which is the way MM sees it. If the tech sell-off continues to gather momentum, GQG could quickly re-rate higher.