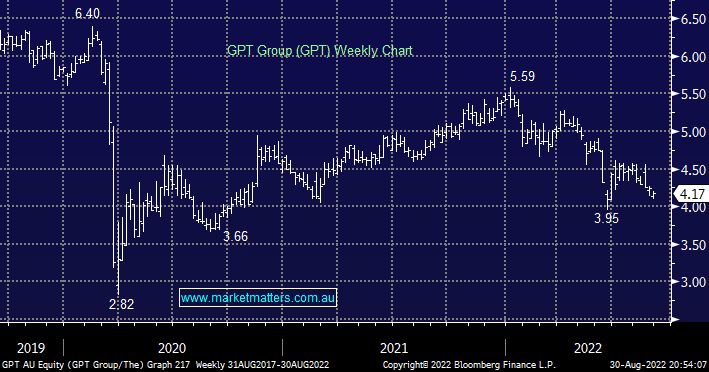

Last week we looked at our preferred retail stock for this portfolio today we’ve turned our attention to the Real Estate Sector which has faced the significant headwind of rising interest rates and falling property prices since late 2021. GPT is an active owner and manager of a diversified portfolio of Australian property assets including the MLC Centre & Australia Square in Sydney and Melbourne Central, on the base level we believe the stocks already trading on an attractive valuation of 12.7x Est 2022 while its expected to yield almost 7% over the next 12-months.

Importantly we liked this month’s 1H21 result which beat the expectations of the market with Funds From Operations (FFO’s) at $302m versus $290m. We particularly liked comments from the board who made 2 encouraging remarks on rents, essentially cash flow was better as they were being paid rents accrued but not paid in FY20 plus they said that retail leasing was tracking better than they expected. However the stocks struggled to gain any traction along with a number of names in the sector, it’s still 25% below its January high and in a similar fashion to JHX mentioned earlier we feel fresh 2022 lows are inevitable.

- The difference between FFO and Op. FCF has never been wider for GPT and we expect it to narrow and with risks associated with debt costs in 22/23 diminished we are a fan of the business.

- Retail metrics were solid while logistics income and development pipeline remain attractive with only a subdued office portfolio dragging the chain.

- We believe the property stocks are close to offering some compelling value with GPT our pick ~8% lower – it’s already trading at a ~30% discount to NTA.