Gold has been a standout performer across global bourses in 2025 as the precious metal punched to new highs but not all boats float as one. The global ETF shown below has 54% exposure to Canadian miners, 18% US and less than 9% to Australia. Unfortunately, it is one of the reasons it pushes new highs almost daily while many ASX names languish. Year-to-date, the GDX has advanced 70% while locally it’s been a very mixed bag from Northern Star (NST) +20.3%, Ramelius (RMS) +48%, Gold Road (GOR) +62%, and Regis Resources (RRL) +74% with not all companies taking full advantage of the runaway gold price.

- Overall, we still see further upside for global gold stocks and the GDX, but the move feels mature.

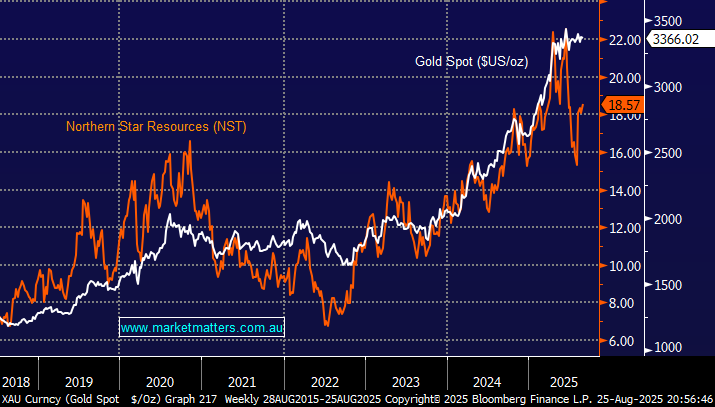

However, the main story with ASX gold names is how precious metal stocks entered a crowded bull market frenzy in June from where most leading names retreated aggressively, such as Evolution (EVN) -27%, Northern Star (NST) -34%, Regis Resources (RRL) -29% , and Ramelius (RMS) -27%. At the same time, all that happened to the gold price was that it stopped advancing; it didn’t particularly fall, but the stampede for the exit door by the ASX names was a perfect example of a crowded trade partially unwinding.

The market now feels more balanced, although there are still no bears in sight regarding gold. It hasn’t helped that a number of local miners have delivered softer operational updates in recent months, far more than their overseas peers. Heavyweight US-listed Newmont(NEM) has illustrated the performance differential of late, its advanced more than 30% in the last 3 months while Northern Star (NST) has fallen -11%. Local gold chatter has gone quiet even with the precious metal within striking distance of new highs, but at MM, we are more inclined to fade the next leg higher by ASX gold names, even if it lacks conviction.

- We are targeting new highs for gold in the coming months, but we doubt if most ASX names can break their “blow-off” June highs.