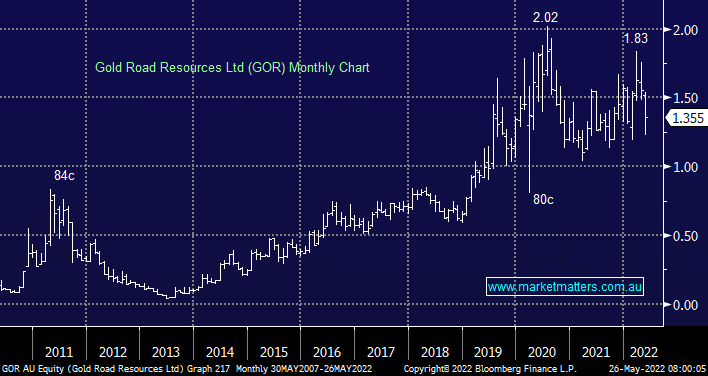

We chose to look at GOR this morning because it’s been a standout underperformer so far this year which by definition makes it a prime candidate for a sharp bounce i.e. year-to-date GOR is down -13.7% compared to NCM which has rallied +3.2%. This $1.2bn WA company has recently acquired DGO Gold with no competition but the stock continues to move in an amplified manner to the underlying gold price. We feel this is a great vehicle for trading as opposed to investing in Australian gold stocks but be warned its very capable of plunging ~20% in a month i.e.. the average range of the last 4-months!

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

James on Ausbiz this morning talking markets

James on Ausbiz this morning talking markets

Close

Close

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM is neutral GOR

Add To Hit List

Related Q&A

Gold Road Resources Ltd (GOR)

Gold Road Resources (GOR) & Goldfields

Thoughts on the 2nd tier gold shares please

MM views on Gold

Gold stocks & info on SPI Futures

Relevant suggested news and content from the site

chart

James on Ausbiz this morning talking markets

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.