Gold stocks & info on SPI Futures

Hi James,

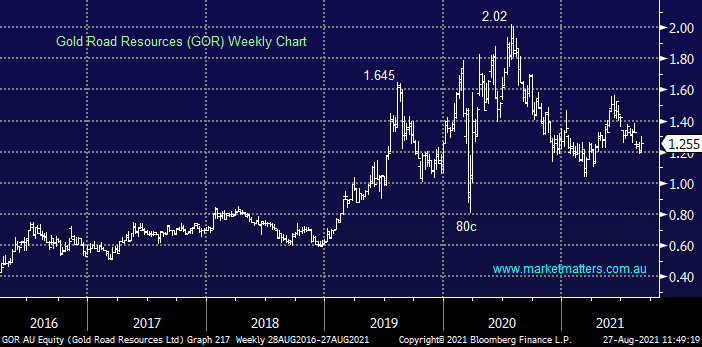

Could you please comment on gold miners in general and NST, NCM and GOR in particular. Gold miners seem to be performing poorly, even as the gold price is improving. Am I missing something? Could it be costs squeezing margins? A matter which has bugged me for some time is the ASX SPI200, which I like to look at each morning as a clue to which way the market will go. The problem is that not all brokers quote this or are even aware of it, and those who do quote it are not always consistent with each other. As I understand it, the Sydney Futures Exchange, now part of ASX, provides a futures market for all or most of its indexes. It seems the ASX SPI200 as quoted is the last contract sale price for one month from the present. Can you confirm this or otherwise define it?

Cheers Stuart.