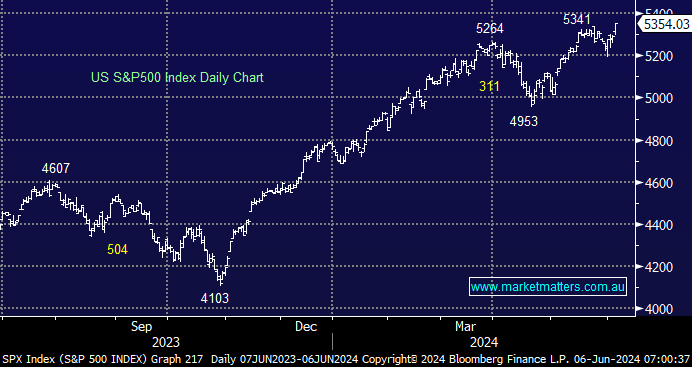

US stocks pushed to fresh all-time highs overnight, taking them within 3% of our target – MM has been bullish since late 2023, and although we have now transitioned to a neutral stance from a risk/reward perspective, it’s definitely not a sell stance. Overnight, private payroll data from ADP showed hiring slowed to 152,000 jobs last month, far below the 175,000 economists expected. The data is the latest sign of weakness in the labour market that investors hope will give the Federal Reserve enough evidence to cut interest rates. Futures markets are now pricing in a more than 60% chance of a cut in September, but Friday’s Jobs Report is likely to have a major impact on this forecast.

- We have been targeting the 5500 for many weeks; hence, we’ve now adopted a neutral stance towards the index.

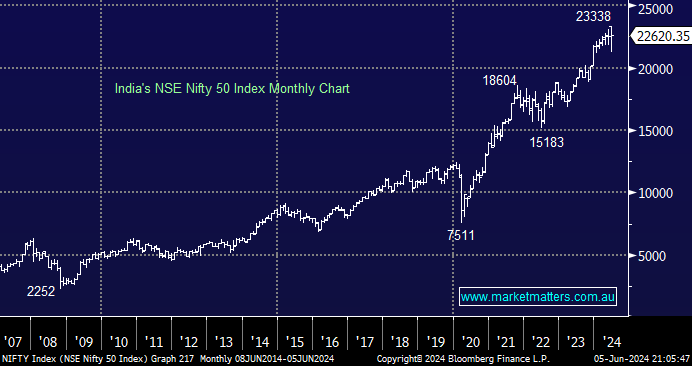

It’s been a volatile week for India’s major equity market as the index plunged almost 9% as election results came in showing the expected victor and market-friendly Modi was in danger of losing the election – he has ultimately held on by forming a coalition government, but it’s a great sign that polls cannot be relied upon; history shows us betting odds are usually closer to the mark, and for the interested, Donald Trump, for all of his indiscretions is a clear favourite to win in November.

- India’s stellar bull market is intact, but volatility looks poised to increase through the 2H of 2024.