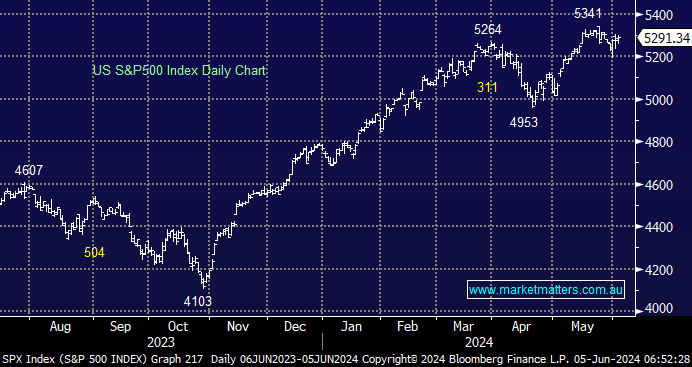

US equities were again quiet overnight, with most indices managing to eke out small gains. Bond yields edged lower but not enough to dispel jitters ahead of Friday as the market continues to walk along the gymnast’s bar: Too strong, we won’t get rate cuts, and too weak, we could see increased concerns that the economy will slip into a recession—the fun job of Jerome Powell and all at the Fed.

- Over the coming weeks/months, our ideal target for the S&P500 is ~5500, but it’s clearly comfortable around 5300 ahead of Friday’s employment data.

Silver caught the eye for the wrong reasons overnight, falling -4% as the US dollar steadied ahead of Friday’s US jobs data in what was a tough session for most metals and commodities. It’s likely to be a simple outcome on Friday: If the jobs report is weak, suggesting rate cuts sooner rather than later, silver will rally, and vice versa.

- We are looking for silver to find support in the $US29-30 region.