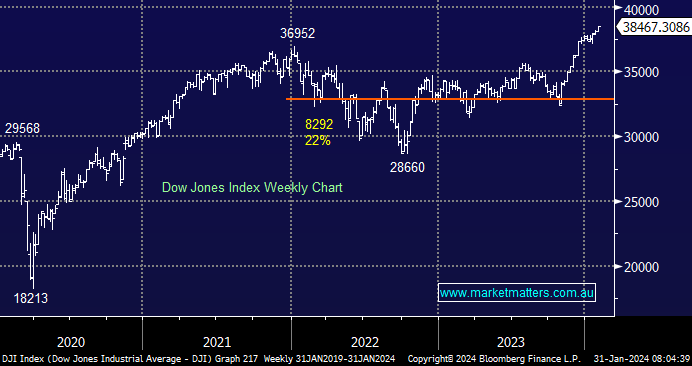

US indices experienced a choppy and quiet session overnight before reporting season really gets underway in earnest – of the main indices, all but the Russell 2000 small cap index is trading at all-time highs. Hence this will be a real test of market valuations after the recent 3-4 months bullish advance. It caught our attention how many bears have gained airtime over recent days, which historically means stocks go higher before encountering selling, i.e. investing with the press/consensus is a dangerous game.

- No change; we are now neutral US stocks, but from a risk/reward perspective, we are not buyers of the current breakout.

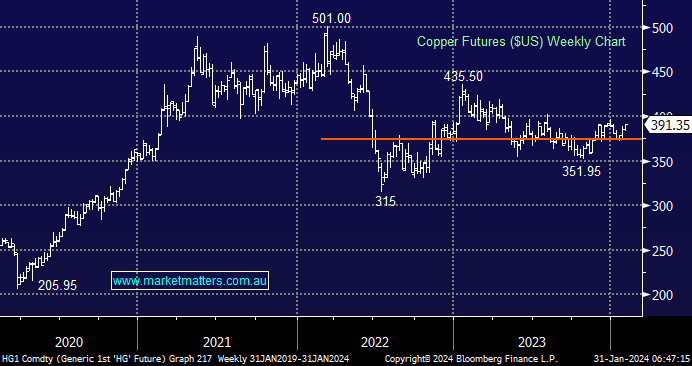

Copper made fresh 5-week highs overnight, a strong performance considering the Evergrande news, i.e. markets which don’t fall on bad news are strong. Last week, Goldman Sachs upgraded its outlook for “Dr Copper” through 2024, they’re anticipating a considerable deficit due to a reduction in mine production and refined copper output. Interestingly, in past Fed easing cycles, prices have seen an increase of 13% in the 75-days following the first rate cut in non-recessionary Fed cutting cycles – source Reuters.

- The industrial metal may be trading in the mid-range of the last 18 months, but it looks poised to break the psychological $US4.00 area over the coming weeks.