US stocks were led higher by Google, as most of us call it after they released Gemini, the “largest and most-capable AI model” it has ever built. Advanced Micro Devices (AMD US) surged ~10% after pledging its new accelerator chips will run AI software faster than rival products. On the sector level, Energy was the only noticeable pocket of weakness, falling ~0.6% on an otherwise strong day for stocks.

- We believe that the tech-based NASDAQ will edge higher into Christmas, but its 2023 advance is maturing fast.

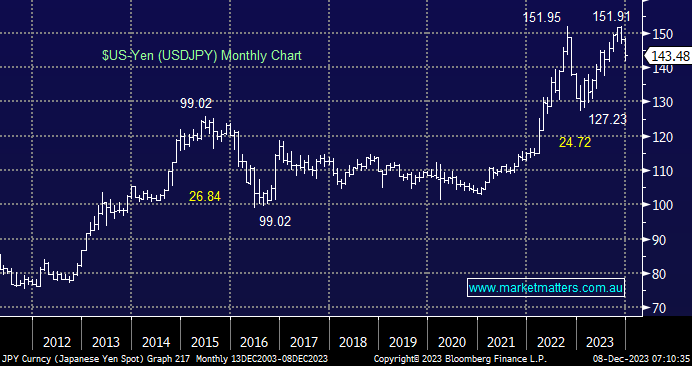

The standout move overnight was the sharp ~2.7% appreciation by the Yen against the Greenback as traders increased bets that the end of negative rates is near; We’re sure the accommodative rate policy feels like a very distant memory to most Australians. The yen strengthened by the most in nearly a year as traders ramped up bets that the BOJ will end the world’s last negative interest rate policy as soon as Christmas. At one stage, the Yen was up 4%, testing August’s lowest lows before paring losses, i.e. the USDJPY.

- Over the coming years, we are looking for the USDJPY to retest this year’s low, below the psychological 130 level.