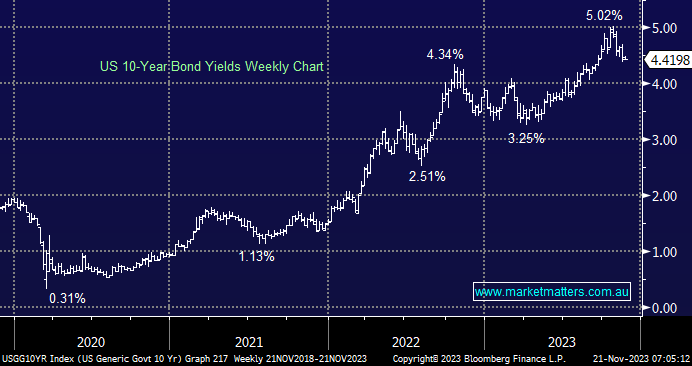

Overnight saw US stocks rally strongly after a $US20bn Treasury auction enjoyed fairly strong demand, leading to gains by both bonds (yields lower) and stocks. The S&P5000 advanced to its highest level since August, while the NYSE FANG+ Index posted fresh all-time highs with all of the majors advancing led by Microsoft (MSFT US), which closed up +2.1% – Nvidia’s important result is looming on Tuesday as many across the US gear up for Thanksgiving on Thursday. Equities were supported by the US 10-years slipping to 4.42% and the $US trading at its lowest level in 11 weeks.

- The NYSE FANG+ index will likely push higher, but the “easy money” is in the rear-view mirror.

One of the main concerns for bond traders has been the increasing supply coming onto the market; hence, last night’s encouraging demand into Thanksgiving enabled the US 10s to drift back towards 4.3% major support, i.e. their late 2022 high.

- We anticipate the US 10s will consolidate between 4.3 & 4.4% as the market awaits signs of waning economic strength after Thanksgiving.