US stocks rallied overnight, with the tech giants leading the way as Treasury yields slid lower following weaker-than-expected jobs data saw buying return to equities, with Microsoft (MSFT US) and Alphabet (GOOGL US) both advancing over +2% while Tesla (TSLA US) stood out surging +6%.

- We remain bullish on US tech short-term, targeting fresh highs into Christmas, let’s hope the local names can embrace such a move if it unfolds.

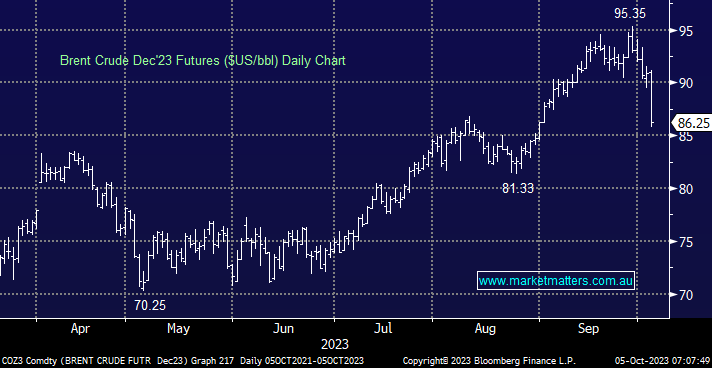

Crude oil was slammed over -5% overnight on economic woes as OPEC+ left output cuts in place and US inventories fell – 2 out of 3 wasn’t good enough. Prices hit their lowest level in a month in what felt/looked like a washout style move. The issue was again all about bonds, with fears of a yield-led recession gathering momentum and lowering forecasts for future demand. This concern that higher yields will lead to slower growth will in fact become a self-fulfilling prophecy, as the higher yields go, the weaker growth will ultimately be and the market should start to focus on this, perhaps the overnight move in Crude was the first sign of this happening.

- We had been looking for a period of consolidation by crude, not a sharp ¬10% fall over just a few days – Woodside (WDS) had pre-empted such a decline, it will be interesting to see how it reacts today.