The US banking crisis continues to slowly improve but that is leading to a bounce in bond yields which is weighing on growth stocks e.g. the US 2 years have rallied from 3.55% to 4.07% in just 3 days.

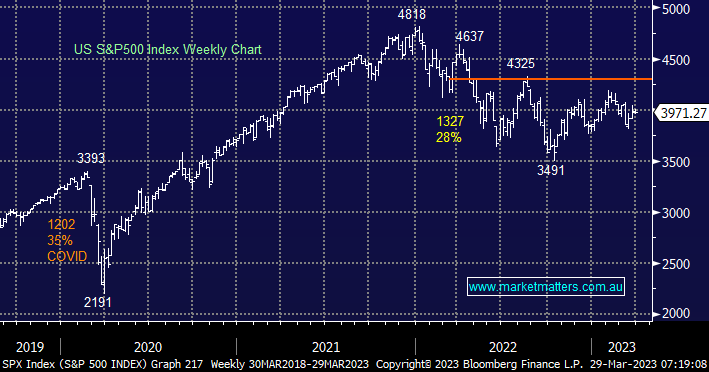

- No change, from a risk/reward perspective we like US stocks into dips with tech remaining our preferred market sector but less so than over recent weeks – our target is now only ~6% higher.

- While we are still net bullish short term any advance is likely to be choppy as opposed to impulsive in nature and we are monitoring closely for risks of failure.

As discussed earlier MM expects risk markets and yields to bounce into April, hence we expect a corrective pullback in precious metals through April especially taking into account their safe haven rally during the banking woes. However, our main takeout is that any pullbacks by silver over the coming months will be a major strategic buying opportunity since the next rally and breakout in silver is likely to be dramatic after it has been consolidating in the 20-25 region over the last year.

- We are initially looking for a 25% upside move by silver over the coming years back to its 2020 highs.